With One Month Until Provincial Election, Commercial Market Unfazed

With one month left until the provincial election, it appears to be business as usual as far as transaction activity in the Vancouver commercial real estate market.

As we asked a couple of months ago, “does a change in government matter?” and at least from an investment and development perspective over the last 60 days, the answer is seemingly no, at least not until there is a confirmed change in government.

The latest EKOS poll shows the NDP leading with 39.3% of intended voters, with the BC Liberals at 27.3%, followed by the Greens at 16.2% and the BC Conservatives at 13.4%.

Source: BC Election 2013 Blog

Source: BC Election 2013 Blog

As a reminder of our previous analysis, here is a look at some market indicators showing the contrast in economic performance between each party’s stay in power. Each chart has been divided to show the two parties’ terms in power (since 1995), as follows:

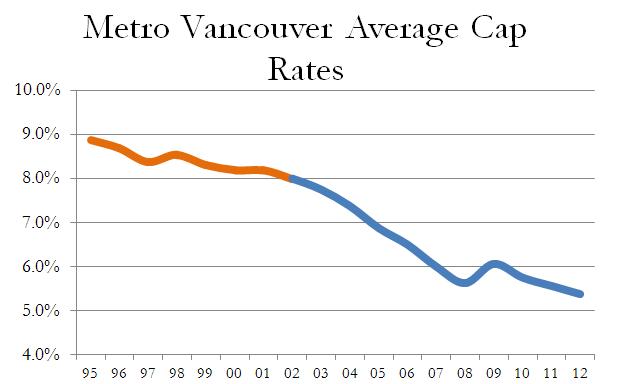

Cap Rates

Capitalization rates take into account many more external factors (federal interest rates, for example), and have shown compression in other markets in Canada, but Vancouver has witnessed cap rates drop moreso than others amid continued strength in the local and provincial economy since the early 2000’s.

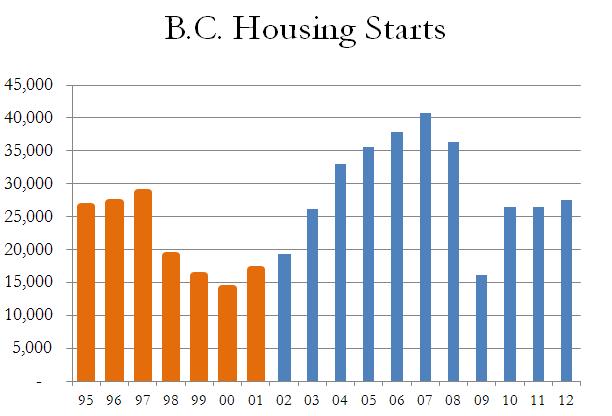

Housing Starts

Developers will appreciate this one. After a stagnant housing market in the late 90’s, construction in Vancouver (and B.C.) went on an unprecedented run between 2002 and 2008 shortly after Gordon Campbell was elected in 2001. Of course, the global downturn in 2008/2009 put the brakes on the market, but it has bounced back relatively well despite recent forecasts of a prolonged slowdown (perhaps due to lack of confidence and risk in the provincial outlook for 2014 and beyond?)

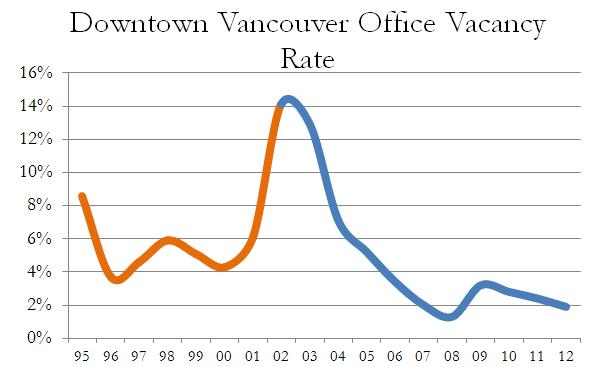

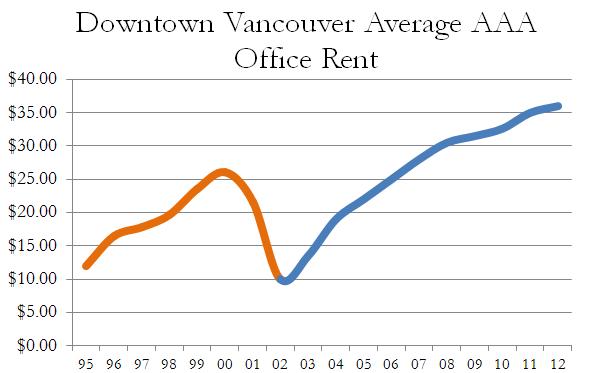

Office Vacancy Rates and Rents

Many will remember a period in the early 2000’s when new office construction wasn’t a topic of conversation in the local commercial real estate industry. In fact, confidence was so bad in 2002 with the vacancy rate hovering around 15% that Bentall decided to halt construction of Bentall 5, now one of Vancouver’s most valuable towers, at half of its height and wait for the office market to improve.

Of course, the office market has always been cyclical irrespective of the political climate. It is largely impacted by macroeconomic factors; however, a look at the Downtown Vancouver office market in terms of rents and vacancy from 1995 to 2013 shows some marked contrast between the NDP and Liberal’s reign on the province.

A Market Forecast Under Adrian Dix?

Stay tuned next month…