Market Spotlight: Metro Vancouver Cap Rates

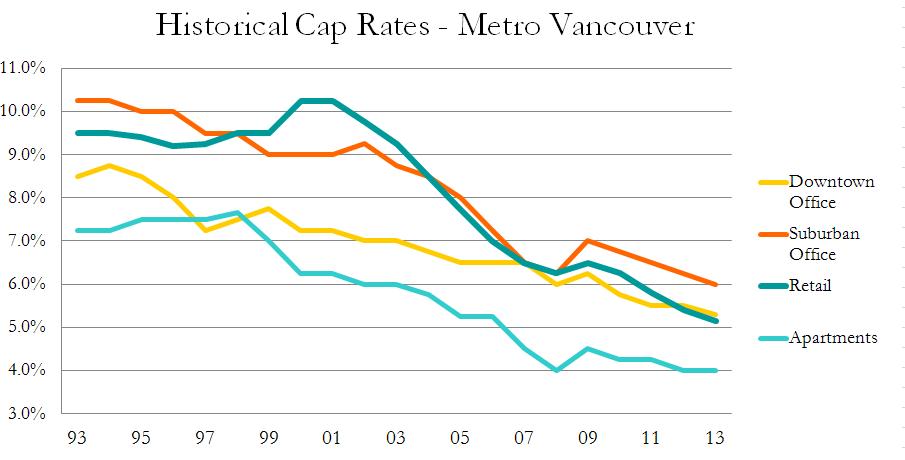

As we’re now well into Q4 2013, a brief look at average cap rates in Metro Vancouver shows (surprise!) no significant change from 2012. Underpinned by an environment of continually cheap debt, cap rates have been flat or remain in slight decline, and now 100 BPS below the rolling 10 year average of 6.2%.

Of course, only in rare cases are Vancouver buyers truly finding yield; it is often more of a ‘safety’ play. With a healthy supply of potential (and anxious) private equity buyers that have amassed significant, undeployed cash reserves in reaction to depressed and uncertain market conditions in recent years, cap rates are being bid down now as much as ever. This, coupled with fiscal authorities in both Canada and the United States continuing to maintain interest rates at historically low levels have resulted in the continuation of historically low cap rates in Vancouver.

The first signs of a shift in this trend may already be occurring with a slight downward trend in transaction activity so far in 2013. A continuation of this trend in 2014 combined with a changing economic/interest rate environment and potentially volatile leasing markets (particularly in office) may finally exert upward pressure on cap rates.

…just don’t tell owners…