Real Estate Buyers Will Need to be Better Operators: JLL

By Paul Brent

Real estate investors have been the beneficiaries of a two-decade decline in interest rates but with rates expected to trend upward again, buyers need to be pickier and focus on operations even as the prospects for landlords are improving along with the U.S. and Canadian economies.

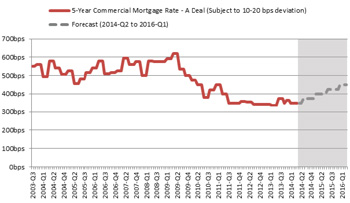

That is one of the conclusions that can be drawn from Jones Lang LaSalle‘s recently released report on Canada’s debt market Commercial Property Financing Renaissance. (The adjacent table is sourced from JLL Debt Capital Markets and referenced in the report.)

“Rates have been declining pretty much every year for 25 years and going forward we are looking at a reversal of that,” said Amar Nijjar, vice-president and practice lead with JLL Canada‘s Toronto office. “Borrowers will have to have some readjustment: buyers will have to see a different type of financial modelling and rely more on income growth than just cap rate-related appreciation.”

The JLL executive said the pressures behind rising bond yields and interest rates are also good news for real estate operators in general.

“They are rising because inflation is getting up and unemployment levels are going down. Those are the …read more

Source: RENX