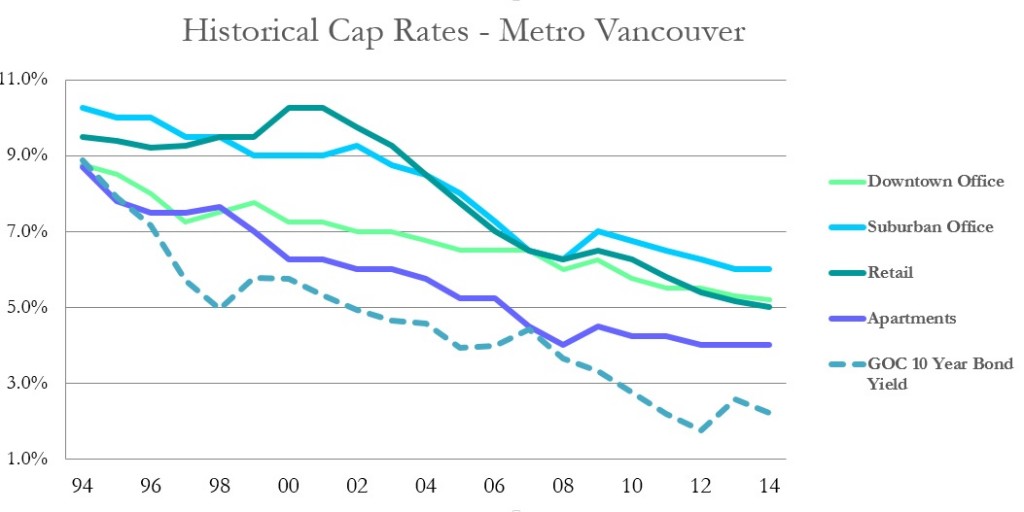

Here is an update to a graph that has been posted here many times previously. Cap rates are continuing a downward or flat trend across most asset classes amid a continued influx of capital and a continued environment of relatively cheap debt and low interest rates.

Suburban office buildings appear to be the one exception in mid-2014, likely reflecting worsening leasing fundamentals and increasing vacancy in many areas such as Burnaby. While there doesn’t appear to be much room for continued compression in the other asset classes, Vancouver tends to be a market that defies logic.

What do you think? Where do you see capitalization rates trending as we finish 2014 and enter 2015….

What do you think? Where do you see capitalization rates trending as we finish 2014 and enter 2015….

[poll id=”6″]

By Frances Bula

Time for all of us to get up to speed here, as First Nations bands around the Lower Mainland and elsewhere are getting increasingly savvy about operating businesses, negotiating deals, and doing development on land they own or have a claim to.

In the wake of the announcement last week about an agreement among the federal government and three local bands to develop two large chunks of land, I went talking to the people behind the scenes who have been watching First Nations grow in the scope of their activities My Globe story here, with a lawyer, a development and a real-estate consultant who have worked with First Nations around the province.

Important for us, too, to understand the differences between developments on reserve land and developments on claimed land.

(One caveat. I referred to Block K as the Shuaghnessy gold club, but Block K, thanks to my informant on Twitter, is actually the chunk of lend just west of the golf club.)

Source:: Frances Bula

Search the Site

12-unit Gleneagles townhouse project proposed in West Vancouver

A new proposal has surfaced for the parking lot next to Waterfront Station.

The redesigned project includes a 26-storey, 416,000 SF office tower, shaped like a tree, cantilevered over the existing station building.

Architect: James Cheng

Details: https://bit.ly/46aUB0W