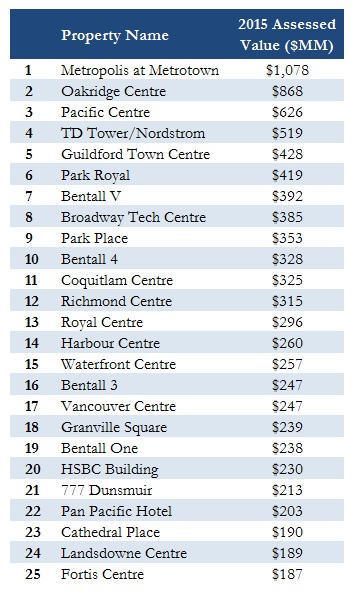

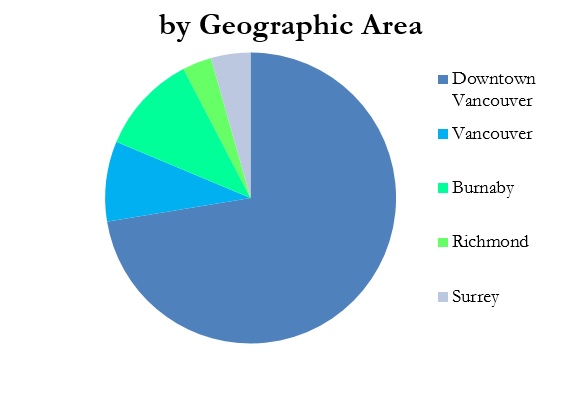

Here is a summary of Metro Vancouver’s most valuable commercial real estate assets. The summary is based on a survey of the top 25 commercial properties ranked by the 2015 tax assessment value. While assessed values don’t neccesarily reflect market values, this analysis provides a fairly accurate snapshot of our city’s most valuable assets:

- Metrotopolis at Metrotown continues to hold its rank as by far Metro Vancouver’s most valuable commercial property, as it has for the last decade. The nearly 1.8M sq ft shopping centre is now assessed at over $1 Billion. This value does not include the adjacent office towers which would likely add another $200 Million, also owned by Caisse de depot, which is Quebec’s largest pension fund manager.

- The redevelopment of Sears into Nordstrom significantly bolstered its assessment value. Including the office towers, Pacific Centre is now valued at over $1 Billion.

- Renovations and improvements at aging regional shopping centres including Park Royal and Guildford Town Centre bolstered values significantly.

- Oakridge Centre’s value had a large increase likely based on it’s 2014 rezoning for over 2,000 residential units.

- Langara Gardens and Landsdowne Centre both fell off this list, but will likely return in the near future. Both properties are slated for redevelopment. Landsdowne in particular is speculated to have significant redevelopment value.

- Pension funds control the vast majority of these larger core/trophy assets. (77% to be exact)

- A group of 6 pension fund managers (some in partnership) control well over 50% of the top 25.

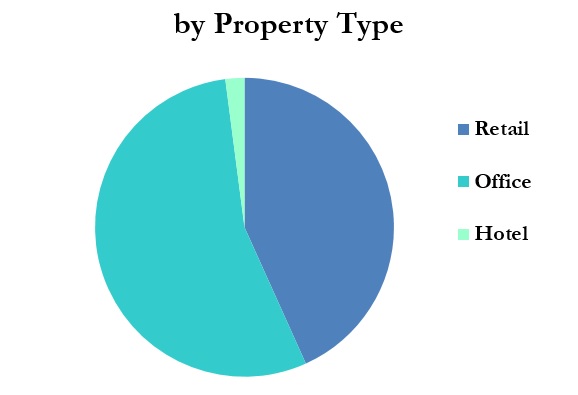

- While the top 3 are super regional shopping centres, 15 of the top 25 are Downtown office towers.