City of Vancouver Sets Out 2019 Inflationary Adjustment for DCL & CAC Rates

The City of Vancouver is seeking approval for their annual inflationary adjustment to DCL (Development Cost Levy) rates and CAC targets.

The inflationary rate adjustment to DCLs and CAC targets are an annual process that allows the City to keep pace with annual changes in property values and construction costs.

The proposed 2019 inflationary rate adjustment represents an increase of 5.2%, reflecting increases in the cost of land and non-residential construction costs. A core principle behind the annual inflationary rate adjustment system is that it should be able to adapt to market changes. As a result of a weakening residential market, it is recommended that this year’s inflationary rate adjustment be applied only to non-residential rate categories, maintaining existing rates for residential uses. The one exception is the phase-in of the Vancouver Utilities DCL rate for high-density residential development on the east side.

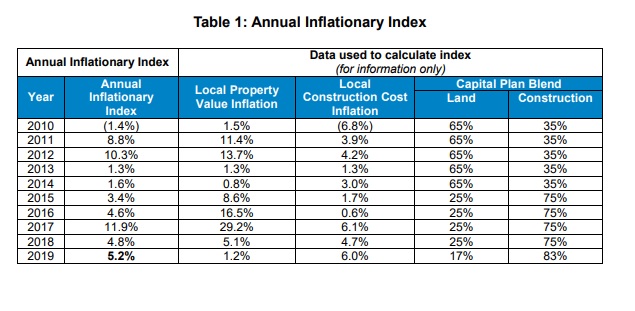

The annual inflation index since 2010 is outlined in the table below:

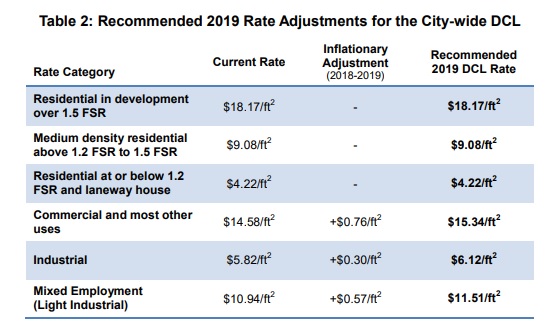

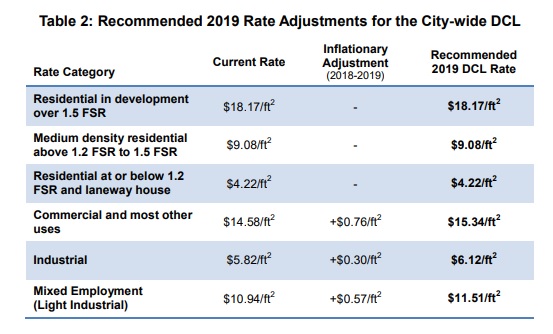

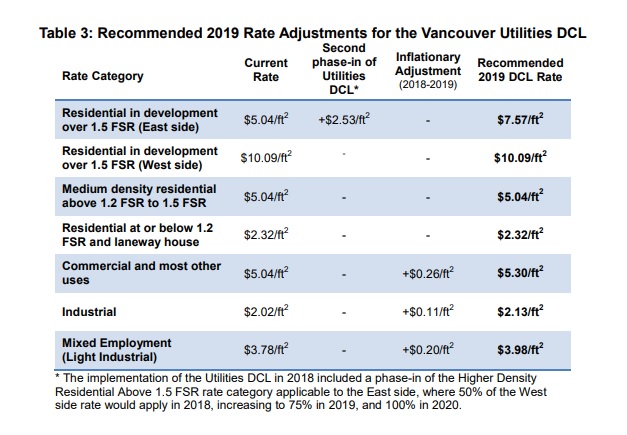

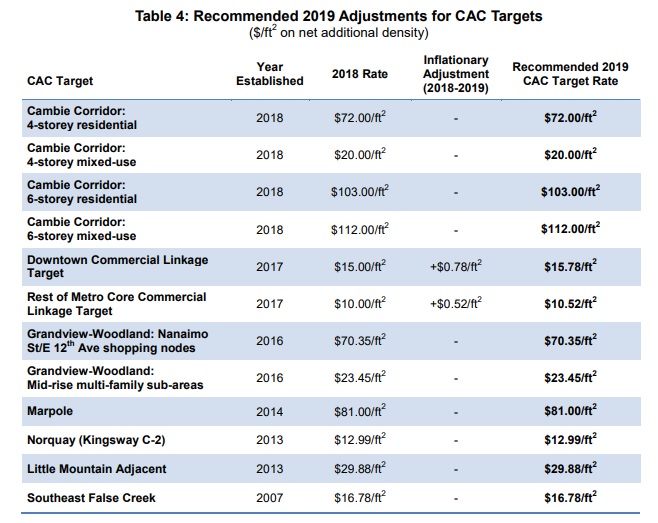

The 2019 rate adjustments are outlined in the following tables from the City Staff report:

The staff report outlines the following economic rationale for the inflationary rates for both residential and commercial:

The staff report outlines the following economic rationale for the inflationary rates for both residential and commercial:

Residential Market

- According to City of Vancouver data, the value of year-to-date building permits

issued (as of March 2019) has declined by 24.1% from last year’s value; - According to CMHC, year-to-date new housing starts in the City (as of May 2019)

have increased by 3.8% compared to 2018; - According to CMHC, year-to-date new housing absorptions in the City (as of May 2019) have declined 20% compared to 2018;

- UDI’s State of the Market report for Q1 2019 also showed that sales across new

concrete condominiums, wood frame condominiums, and townhouses have

declined to some of the lowest levels observed in Vancouver since Q1 2013 and that inventories of unsold units are trending upward; - UDI’s State of the Market report for Q4 2018 indicated that new tax measures and stricter mortgage lending policies have contributed to uncertainty and pessimism in the Metro Vancouver market from real estate investors;

- According to data from the Real Estate Board of Greater Vancouver (April 2019),

resale home prices have declined year-over-year for all housing types in all locations of the region. In Vancouver, year-over-year resale prices are down between 9% and 14% depending on the location and type of housing.

.

Non-Residential Market

• Colliers, Cushman & Wakefield, and CBRE indicate strong demand for office space with vacancy rates reported as low as 2.0% in Downtown Vancouver along with high amounts of office floor area absorption and increased average asking rents. There is also a large amount of supply anticipated for completion in the early 2020s with large multinational tech firms opening new offices in Vancouver.

• Colliers, Cushman & Wakefield, and CBRE also report increased demand for industrial floor space with vacancy rates reported as low as 1.9% in Vancouver. New supply is being constructed featuring a mix of ground floor production space and office on upper levels.

Target allocations of DCL revenues are estimated as follows:

- Replacement housing – 36%

- Transportation – 25%

- Parks – 18%

- Childcare – 13%

- Utilities (Upgrades for Affordable Housing) – 8%

A full copy of the 2019 Annual Inflationary Rate Adjustment to Development Contributions and Associated DCL Amendments can be viewed here: http://council.vancouver.ca/20170725/documents/p8.pdf