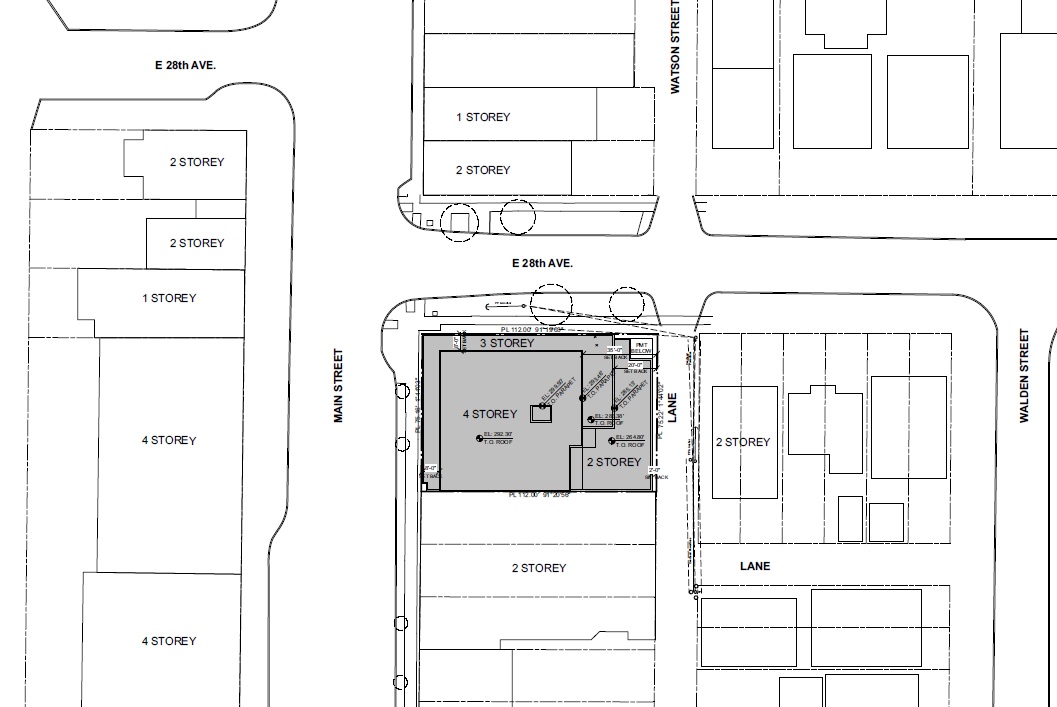

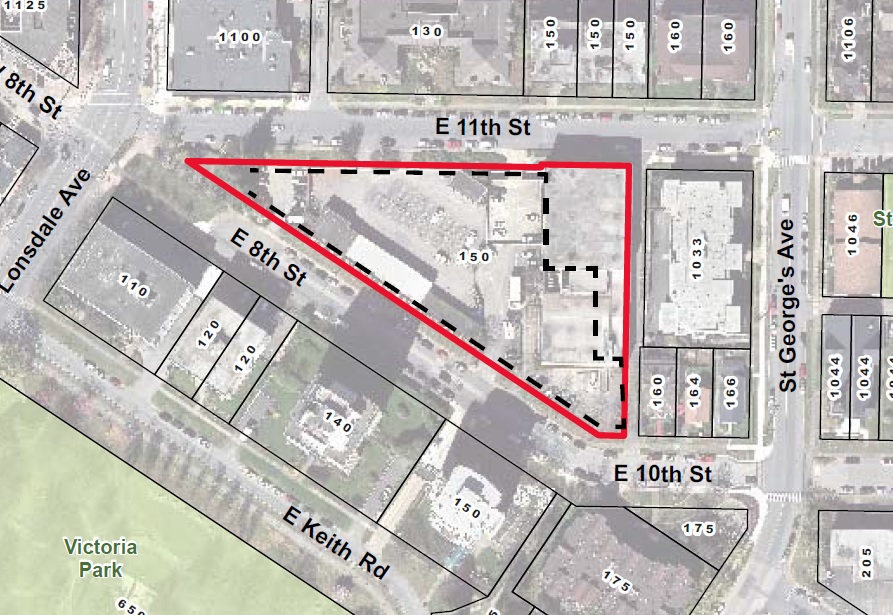

M28 Holdings Ltd. has submitted a development application for a 75′ x 112′ site at the Southeast corner of 28th and Main for a new rental apartment building. The C-2 zoned site is currently occupied by single storey retail including Le Gent Antiques on the corner.

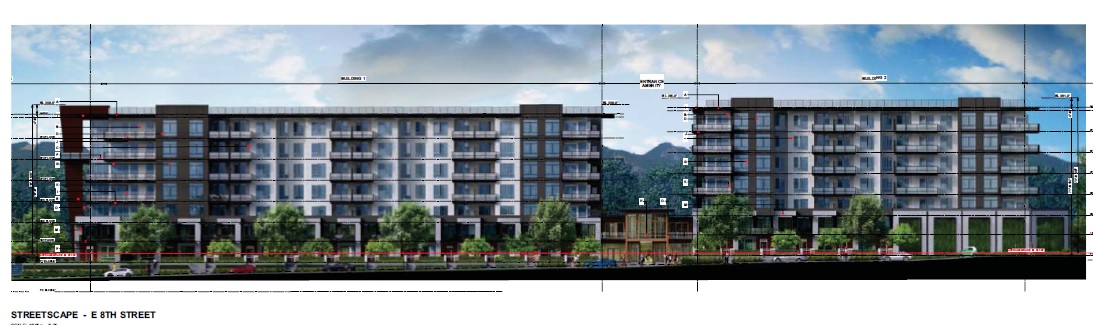

The new development will be 4-storeys and will include:

- retail and restaurant uses on the ground floor;

- 21 rental market rental units;

- a total density of 2.5 FSR;

- a building height of 45 feet;

- two levels of underground parking accessed from the lane.

Under the site’s existing C-2 zoning, the application is “conditional” so it may be permitted; however, it requires the decision of the Director of Planning.

The site sold in December 2016 for $6,980,000, or $341 per buildable SF based on the application.