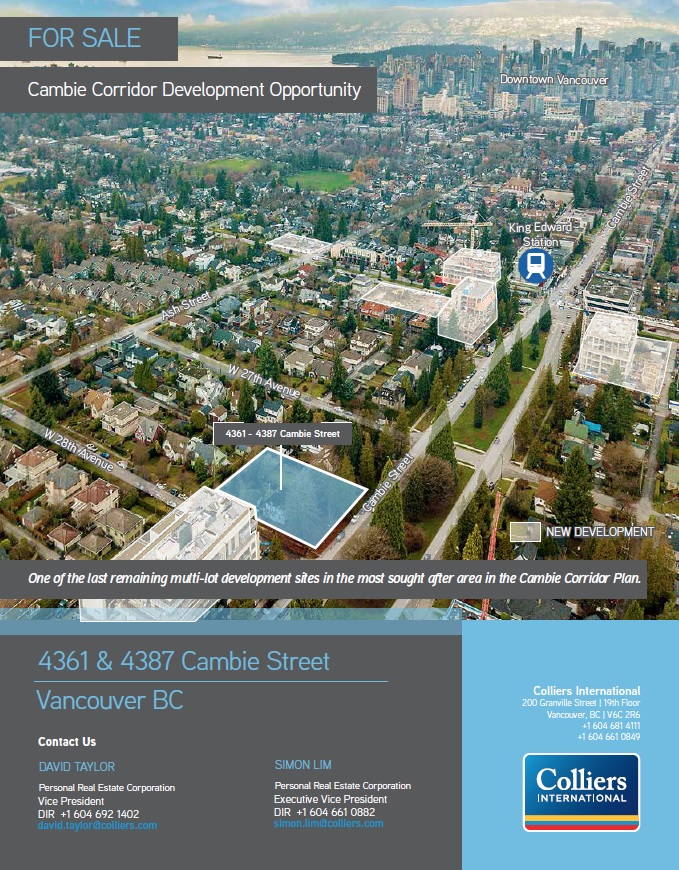

I am pleased to introduce this phenomenal 20,250 SF development site on the best stretch of the Cambie Corridor.

Please download the brochure here: 4361-4387CambieSt_Van_Brochure_E Copy

I am pleased to introduce this phenomenal 20,250 SF development site on the best stretch of the Cambie Corridor.

Please download the brochure here: 4361-4387CambieSt_Van_Brochure_E Copy

A full rezoning application has been submitted for the 3.3 acre Jewish Community Centre and Louis Brier Homes property at 950 West 41st Avenue, just East of Oak Street.

The plan calls to amend the existing CD-1 zoning to allow a phased redevelopment of the property that became possible under the Oakridge Transit Centre Policy Statement adopted by the City in 2016 in order to facilitate the eventual redevelopment of the Oakridge Transit Centre site across the street. The Jewish Community Centre site is located directly across the street to the South and was also redesignated given it’s adjacency.

Details of the rezoning proposal include:

Underground parking, with 693 vehicle parking spaces and 250 bicycle parking spaces, is proposed. The application proposes a total density of 4.47 FSR.

The architect for the project is Acton Ostry Architects.

The full rezoning application can be viewed here: http://rezoning.vancouver.ca/applications/950w41stave/index.htm

0951705 BC Ltd. has applied to the City of Richmond for permission to rezone 8871, 8891, 8911, 8931, 8951, 8971 and 8960 Douglas Street from the “Light Industrial (IL )” zone and the “Auto-Oriented Commercial (CA)” zone to a new site-specific zone in order to permit a new 6-storey hotel development, entitled “Hyatt Place” in the City Centre’s Bridgeport Village.

The site includes a non-contiguous portion on the south side of Douglas Street. The 6-storey hotel building will be on the north side of Douglas Street and a single-storey

commercial building will be on the south side. The hotel site is 25,920 SF and is currently vacant.

Key components of the proposal include:

The architect for the project is GBL Architects.

A development application has been filed by Man 6 Holdings Inc., a project company made up of the partners of EKISTICS Architecture. The site is 6,039 SF, zoned I-1 and is located at the corner of West 6th Avenue and Manitoba. The proposed development concept is a new four-storey, mixed industrial and commercial building consisting of ground level Manufacturing use and Office uses on the 2nd to 4th floor. Details include:

Ekistics describes the design rationale: “EKISTICS is currently located at 1925 Main Street. We are excited to be designing and building our own studio space within this neighbourhood. We have been actively searching for a new company home for the past four years. We managed to stretch our resources to purchase this land in order to keep our office close to where people live and in a desirable and exciting neighbourhood. We feel passionate about our city, and being part of making it a great place to live and work. Our goal is to redevelop the site to include one floor of light industrial use, and three floors of office use. EKISTICS will occupy 2 of the 3 office floor for its studio. Our intention is to lease the main and second floors to local businesses which will compliment our design work.”

Under the site’s existing I-1 zoning, the application is “conditional” so it may be permitted; however, it requires the decision of the Director of Planning.

The architect for the project is Ekistics Architecture Inc.

The site was acquired in Mach 2017 for $5,000,000.

Exclusive:

Brookfield has flipped the Shangri-La Vancouver (now Hyatt) retail podium to Aquilini Group for $55 million. Brookfield bought the property last summer.

Full story:

https://howardchai.substack.com/p/shangri-la-vancouver-hyatt-retail-brookfield-aquilini

12-unit Gleneagles townhouse project proposed in West Vancouver

A new proposal has surfaced for the parking lot next to Waterfront Station.

The redesigned project includes a 26-storey, 416,000 SF office tower, shaped like a tree, cantilevered over the existing station building.

Architect: James Cheng

Details: https://bit.ly/46aUB0W