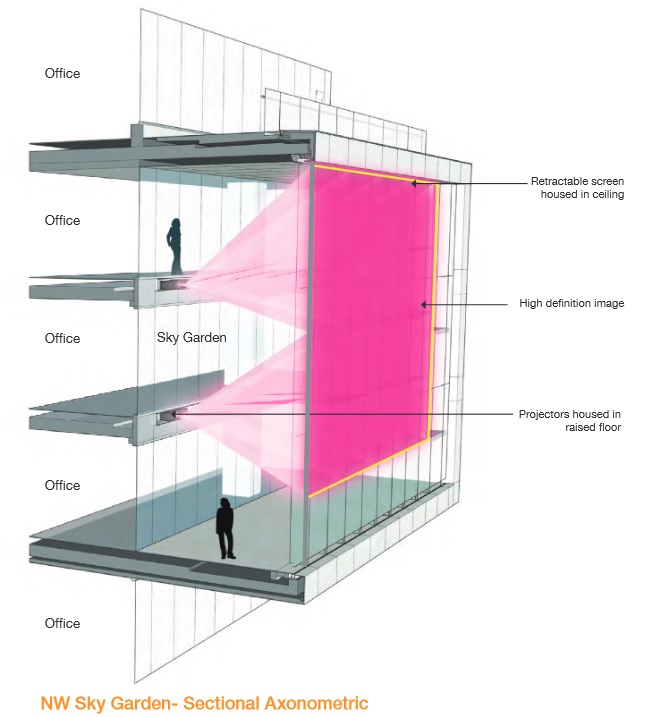

Details about the new ‘Media Facade’ on the Telus Gardens office tower are emerging and it seems like it will be a distinctive feature. The screen is located on the west façade, between the 16th and 18th floors, and is approximately 26′ x 40′. It is only visible in one direction from both Georgia and Seymour Streets.

Here’s a description from the application:

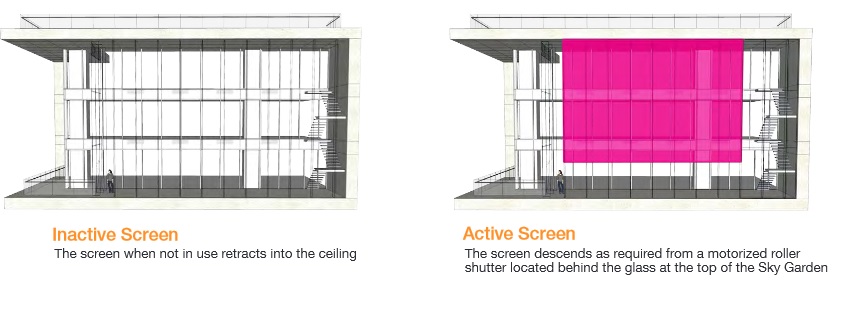

“A simple and proven technology of back projection onto a retractable screen will provide a glare-free static image or full motion video. At dusk the screen descends, and the façade transforms.

When the performance is over, the screen ascends and the office tower is back to business. Content will be a mix of public art (including community messaging) and tenant exposure with the City of Vancouver reserving the right for special event programming.”

More details here.