An interesting development application was submitted this week for a property at the Southwest corner of Granville and 6th, owned and occupied by Zonda Nellis. The plan is relatively unique since the site is only 30′ x 120′ (3,600 SF). The site is zoned C-3A so the density max of 3.0 FSR is conditional. It is exceedingly rare to see a site of this scale seek a DP for a density as high as 3.0 FSR. Sometimes this type of plan makes sense on corner sites if assembly isn’t possible, or if as the case may be here, the property has been owned for a long time and the cost base of the land is quite low.

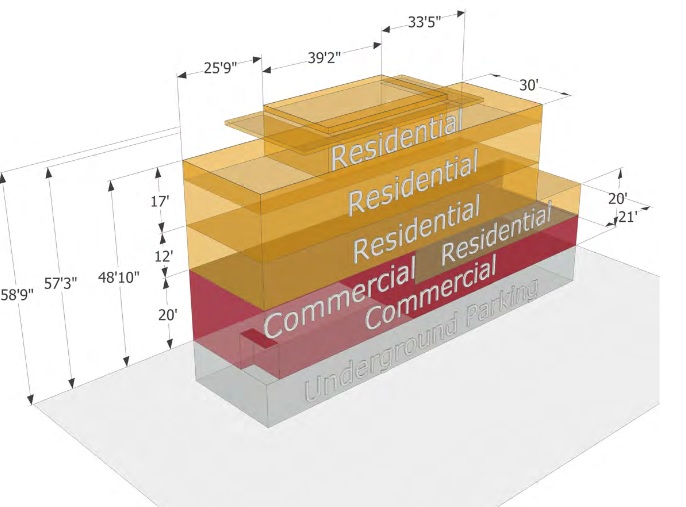

The plan calls for the existing single-storey retail building to be replaced with a 5-storey mixed-use development with retail at grade and four levels of residential above, with one level of underground parking below. Details include:

- 2,464 SF of retail space (3 CRUs)

- 8,336 SF of residential space

- A total density of 3.0 FSR (10,800 SF)

- A total of 4 parking stalls (one per residential floor)