The City of Vancouver released a report and presentation to council today which outlines the proposed process and timeline for a new City-wide Plan which hasn’t occured in almost a century.

The 1995 City Plan also launched a neighbourhood-by-neighbourhood process to create community ‘visions’ and neighbourhood centres. However, the neighbourhood plan process took 14 years to progress, lost momentum, and was eventually redirected into a series of area and community plans, several of which have been completed (Marpole, West End, Downtown Eastside, Grandview-Woodland, Cambie Corridor, etc.)

Below is a brief overview of some of the relevant points presented to City Council as to the planning process:

Objectives

Aside from general planning for future growth, the City outlines the objectives of the City-wide Plan as follows:

- Advancing reconciliation between the City and the Musqueam, Squamish, and Tsleil Waututh Nations and urban Indigenous communities

- Pursuing reconciliation with our historical past, including traditionally marginalized

communities. - Maintaining Vancouver as a diverse and inclusive community

- Increasing and protecting housing supply that is locally affordable

- Addressing the city’s transportation needs

- Growing local jobs in a sustainable and diverse economy

- Enhancing social well-being and local food security

- Improving public amenity provision and cultural vitality

- Rapidly reducing greenhouse gas emissions to help tackle the climate crisis

- Planning for complete neighbourhoods, exploring new housing types and densities

- Enhancing sociable and safe places for people and vibrant livable, well-designed

neighbourhoods and shopping streets - Making connections to the metropolitan region and Cascadia

Timing

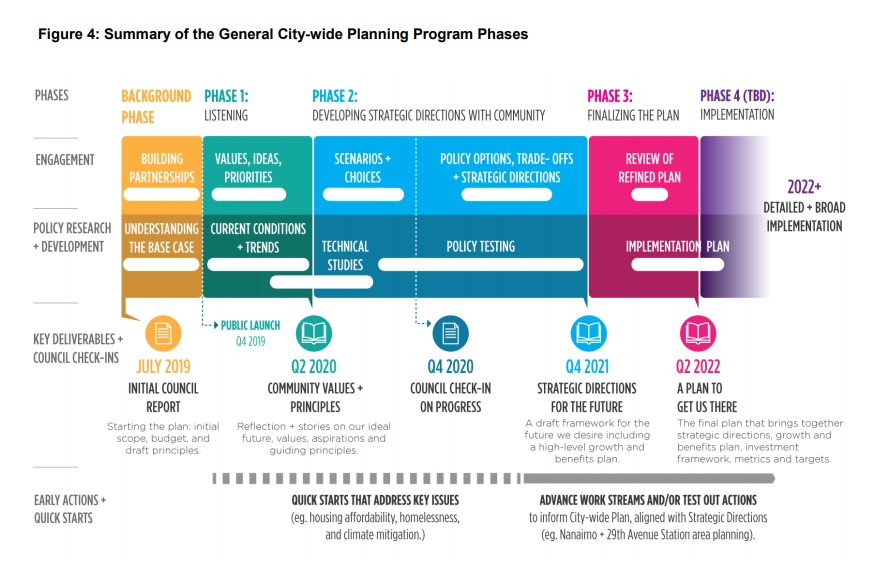

The staff report indicates a general planning and engagement process that is anticipated to take about three years from Council approval of the planning program to adoption of the Citywide Plan. The target date is Q2 2022.

Here is a diagram outlining the various phases:

Impact on Current Zoning/Policies

A new City-wide Plan will potentially impact zoning policy in many areas of the City, including those that already have existing community plans or rezoning policies. The report offers some suggestion as to how these may be dealt with:

Recently Completed Area and Community Plans:

Over the past ten years, the City has approved several new community plans including: Cambie Corridor Plan (2018), Northeast False Creek Plan (2018), Joyce Collingwood Station Area Precinct (2017), False Creek Flats Plan (2017), Grandview-Woodland Community Plan (2016), Marpole Community, Plan (2014), Downtown Eastside Plan (2014) West End Community Plan (2013).

The report notes: “The intent of the City-wide Plan is not to revisit policy directions covered under these plans; however, through the process there will be opportunity to ensure these plans align with the identified values and directions of the new City-wide Plan. Updates and enhancements to various policies and plans may arise in order to improve directions towards the overall vision for the city, or respond to urgent issues and opportunities that arise during the planning process.”

City-wide Policies:

“There are also a number of city-wide land use policies that have been adopted over the years that will be considered through the City-wide Plan process. While applications under these policies/programs will continue to be considered during the planning process, their long-term applicability will be informed by the City-wide Plan. Examples include: Rental 100; Moderate Income Rental Housing Pilot Program (MIRHPP); and the Affordable Housing Choices Program (AHCP).”

Community Visions:

Community Visions including the Norquay Village Neighbourhood Centre Plan and Kingsway and Knight Neighbourhood Centre: Housing Area Plan, will be re-explored through the City-wide Plan process.

Rezoning Enquiries During the Planning Process:

It is being recommended that existing rezoning policies remain in effect during the process, until such time as specific policies are brought forward. This would be anticipated to occur generally towards the end of the planning program, likely in conjunction with the adoption of new policy (e.g. a new City-wide Plan) addressing the areas for which older policy is being updated or repealed to align with new City-wide Plan directions.

Concurrent Planning Programs

The report indicates that time sensitive plans that are already in process including the Broadway Plan and Jericho Lands Policy Statement will continue on and will be coordinated and connected with the City-wide Plan as best as possible.

The City-wide Plan is estimated to require 30-35 staff and will cost $17.9 Million.

General Manager of Planning Gil Kelley has suggested that if approved by Council, community consultation will get underway in or around October 2019.

The full staff report entitled: A City-wide Plan for Vancouver: Report back on General Planning and Engagement Process can be viewed here: https://council.vancouver.ca/20190709/documents/rr1.pdf