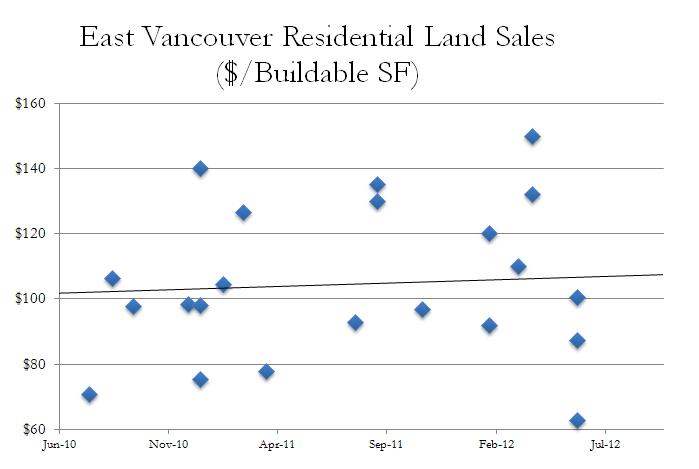

Residential developers continue to look to East Vancouver for new opportunities given the increasing scarcity and rising cost of developable sites in the Downtown and Westside areas.

A landmark sale for East Vancouver was Westbank’s acquisition of the Canadian Tire site at 2220 Kingsway, in the Norquay Village plan area. That site traded at $34,088,000, representing $135 per buildable sq ft.

A review of sales over the past two years shows a general average price of approx. $100 per buildable sq ft., with values varying depending on site specific conditions such as location and zoning. Sites in and around Main Street show prices above $150 per buildable sq ft, where sites along Kingsway have shown a range of $80-100 per buildable sq ft. Other increasingly active corridors include East Hastings and Fraser Street.

(click above for greater detail)

Source: Colliers research.