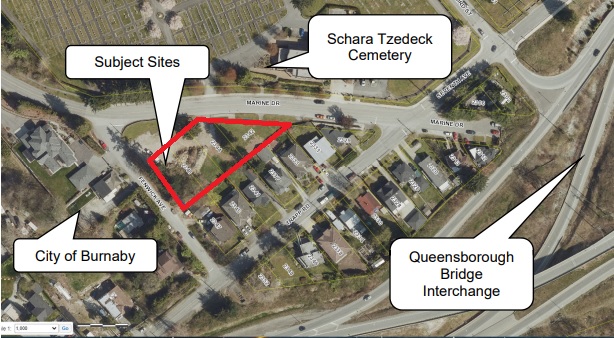

A pre-application has been submitted for the development of a vacant plot of land just South of the Schara Tzedeck cemetery, on the Western Edge of New Westminster, bordering Burnaby and just Northwest of the Queensborough Bridge. There is an existing enclave of single family homes directly south of the site, and the cemetery to the north and east.

The site at 2342 – 2346 Marine Drive is 23,500 SF and is a short walk to the 22nd Street Skytrain Station, though outside of any OCP designation to allow rezoning.

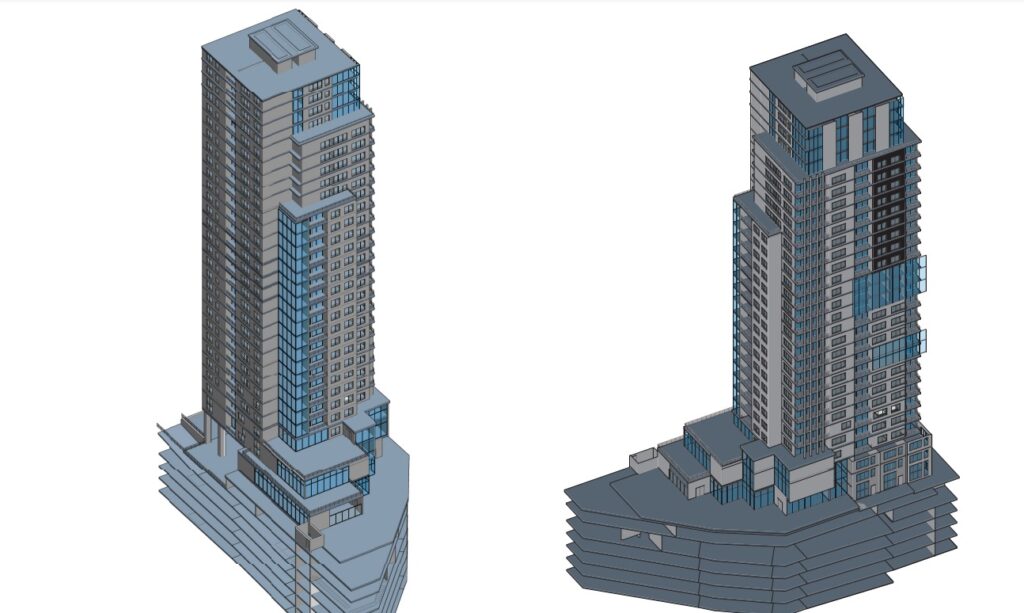

The proposal for the site includes a 30-storey rental apartment building that includes below market rental units. Details of the proposal include:

- 230 ‘near market’ & below market rental units

- 185 rented slightly below market rents (10% below market rents)

- 45 below- and nonmarket units (20% of units)

- 2,066 sq. ft. of ground floor retail;

- 3,180 sq. ft. childcare space;

- 4,574 sq. ft. community use space;

- a total density of 8.7 FSR.

- 246 underground parking stalls.

The application describes the project rationale: “As a not for profit organization, the board is looking to create an on-going source of revenue to service the organization for years to come. The best way forward to meet their objectives, and to service the community they are in is to create a development consisting of secured market rental and affordable rental housing. To that end, 20% of the residential units are to be designated as affordable rental units, or 46 units in the proposed design.”

The architect for the project is collabor8 Architecture + Design (BC) Inc.

The proposal is before the Land Use and Planning Committee, and will require further staff review before becoming a full application.