Just ask any developer; it’s becoming increasingly difficult to find sites to build condos or mixed-use developments in the City of Vancouver. Despite the buzz in the media about developers running City Hall, an burgeoning supply of single family land assemblies, and spot rezonings occurring all over the place, the vast majority of rezoning and development activity outside of Downtown Vancouver is presently confined to areas such as the Cambie Corridor and Southeast False Creek (“SEFC”), both of which are near transit and underwent lengthy master planning phases in the past 5-10 years to add moderate density; typically averaging 3.0 FSR or less. 15 of the 40 currently proposed rezoning applications in the City of Vancouver fall within these two areas alone. Furthermore, of the other 16 proposed rezoning applications that are located outside Downtown/Chinatown, none are for condo developments; none! The applications are all for market rental, social housing or institutional uses. Of course, this does not jive with the public perception that Vision Vancouver has granted spot rezonings for condo towers all over town, a view which does have some merit given pre-planning phase approvals for such developments as PCI’s Marine Gateway and Westbank’s Granville and 70th developments in the past few years. Nevertheless, more recent direction shows that the City has definitively pulled on the reins of both area plan policy work and speculative rezoning applications.

Outside of the Downtown, Cambie Corridor and SEFC areas, developers are facing scant opportunities to find land in a City that is becoming entrenched as a predominantly wealthy single family enclave with over 65% of land still dedicated to this lowest form of housing density that existed nearly 100 years ago. While City of Vancouver planning staff have made an attempt under Brian Jackson’s oversight to pursue gentle densification of various neighbourhoods in forms such as stacked townhouses and fee-simple rowhouses; it has been largely met with resistance by neighbourhood groups who, in many cases, oppose even the most benign forms of density that threaten the single-family neighbourhood ideal. Likewise, affordable housing activists have argued that $800K townhouses are not a solution, even in large areas where $2M houses are the only option for home-ownership. The end result is that positive planning processes such as that which commenced for Grandview-Woodlands in 2013 turn into endless community consultation and opportunities for redevelopment are deferred for several years.

In a time where rezoning and the public approval process in general is an increasingly contentious and politically sensitive endeavor, developers are fleeing to land where there is the least risk. And where is that? Pre-zoned land. Certain zoning types have become the primary target for many developers and investors over the past 5 years or so; including:

- C-2 (mixed-use zoning on various arterials outside downtown)

- C-3A (mixed-use zoning primarily in the Broadway/Mt. Pleasant areas)

- RM-8 & RM-9 (new townhouse and 4-storey zones respectively. Marpole only so far)

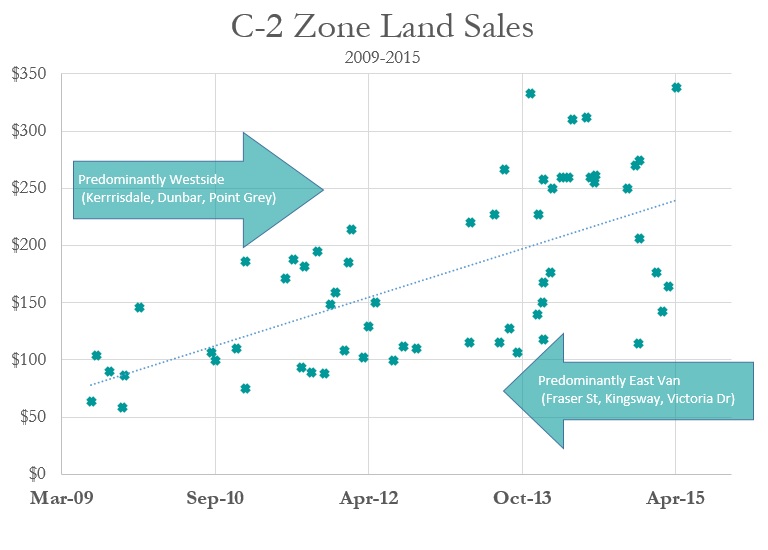

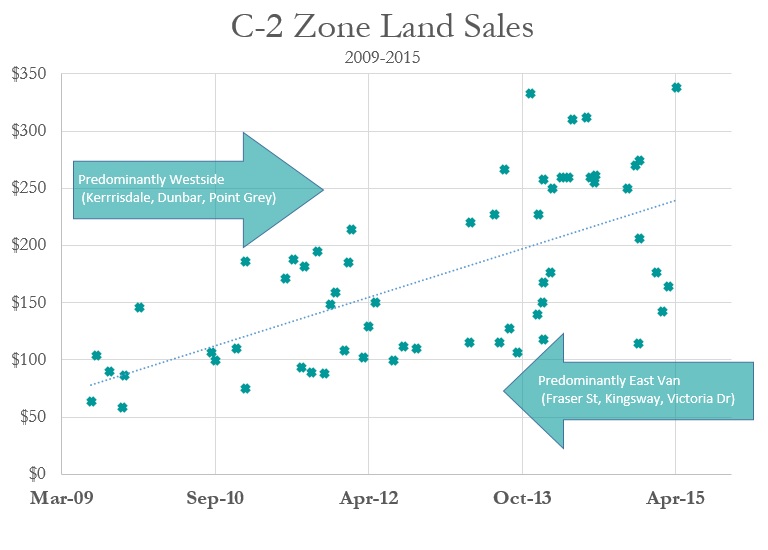

Here is a quick look at sales of C-2 zoned properties in the City of Vancouver to show the effect of the aforementioned increase in demand for pre-zoned land.

For those unfamiliar with C-2 zoning, it is a commercial mixed-use zoning scattered throughout the City’s arterial streets (excluding Downtown). The C-2 zone allows a total density of 2.5 FSR and a total height of 4-storeys. What makes it one of the more sought after zones by developers is that it allows residential above the ground floor, and is found in wealthy established areas such as Dunbar and Kerrisdale, as well as emerging areas like Fraser Street and Kingsway. Existing commercial properties on any sites large enough to accommodate underground parking, and that do not have long-term leases in place are being snapped up all over the City.

The sales show the difference in values between East Vancouver and the above-mentioned areas of the Westside, which of course support higher condo values and retail lease rates relative to East Van. More apparent however, is the increase in values city-wide. While previously averaging around $125 per buildable SF as recently as 2010, the average has now shot past $200 per SF, with recent trades in Kerrisdale well over $300 per buildable SF, and Main Street trades now being reported as high as $250 per BSF. $300 per BSF is a figure which is only supportable in an exclusive and already wealthy area that can justify condo sales approaching $1,000 per SF. The lack of available sites in these areas helps to create the exclusivity that supports the underlying sales, as opposed to areas like Cambie and SEFC where the areas have been, and still are, being inundated with new condo inventory. Speculation may also be a factor where investors are simply buying existing C-2 zoned income properties and holding them, but this has been less prevalent and is not included in the sales charted above.

The sales show the difference in values between East Vancouver and the above-mentioned areas of the Westside, which of course support higher condo values and retail lease rates relative to East Van. More apparent however, is the increase in values city-wide. While previously averaging around $125 per buildable SF as recently as 2010, the average has now shot past $200 per SF, with recent trades in Kerrisdale well over $300 per buildable SF, and Main Street trades now being reported as high as $250 per BSF. $300 per BSF is a figure which is only supportable in an exclusive and already wealthy area that can justify condo sales approaching $1,000 per SF. The lack of available sites in these areas helps to create the exclusivity that supports the underlying sales, as opposed to areas like Cambie and SEFC where the areas have been, and still are, being inundated with new condo inventory. Speculation may also be a factor where investors are simply buying existing C-2 zoned income properties and holding them, but this has been less prevalent and is not included in the sales charted above.

The above price trend holds true for the C-3A zone, as well as other zones which allow the developer to proceed with only a development permit and avoid the lengthy rezoning process.

Land values for C-2 zoned properties and in other pre-zoned areas will continue to be in high demand for developers as long as the opportunities for rezoning remain limited as they are now, and as long as the City of Vancouver – both City Hall and it’s citizens, continue to support a future in which the majority of the City’s land area continues to be dedicated to a low-density, exclusive and unaffordable housing type – the single family home. Similar to single family lots, they aren’t really expanding these zones, and as they are redeveloped the supply diminishes while the demand grows stronger.