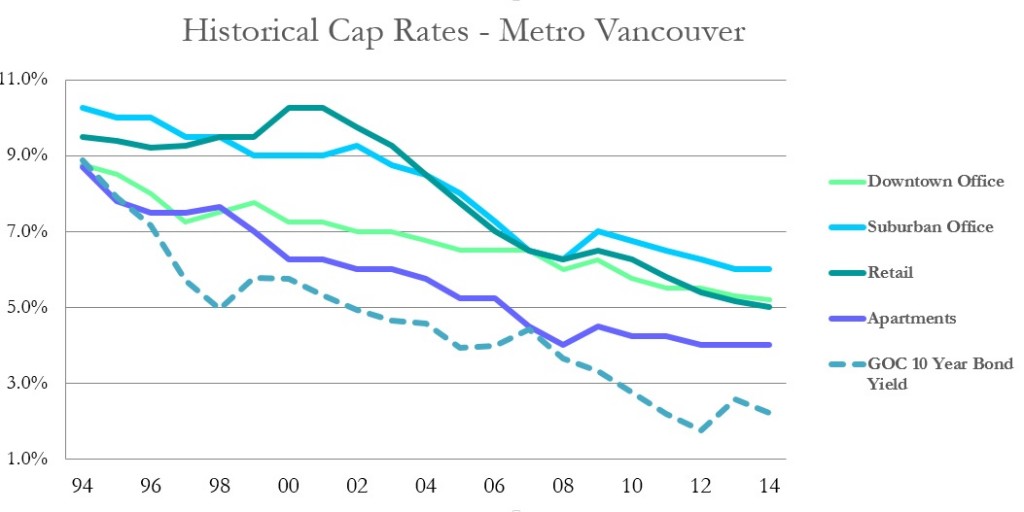

Here is an update to a graph that has been posted here many times previously. Cap rates are continuing a downward or flat trend across most asset classes amid a continued influx of capital and a continued environment of relatively cheap debt and low interest rates.

Suburban office buildings appear to be the one exception in mid-2014, likely reflecting worsening leasing fundamentals and increasing vacancy in many areas such as Burnaby. While there doesn’t appear to be much room for continued compression in the other asset classes, Vancouver tends to be a market that defies logic.

What do you think? Where do you see capitalization rates trending as we finish 2014 and enter 2015….

What do you think? Where do you see capitalization rates trending as we finish 2014 and enter 2015….

[poll id=”6″]