Lynn Valley is one of North Vancouver’s two Town Centre areas. It’s also the District of North Vancouver’s Municipal Town Centre in the Metro context, which is defined as “a municipal-wide centre or hub with medium and higher density uses including residential, commercial, employment, recreational and civic”.

Located in the heart of Lynn Valley, the Town Centre core is currently focused around Lynn Valley Centre, and the new Lynn Valley library and civic plaza. From the District’s OCP: “Heritage buildings and features, parks and views to local mountains reflect the rich cultural and natural history of Lynn Valley. Building on the quality design, liveliness and sense of place initiated by the new Lynn Valley library and civic plaza, there is an opportunity to revitalize the Town Centre into a more vibrant, pedestrian oriented, mixed use centre with housing choices and inviting street level shopping along a High Street with sidewalk cafes and community spaces. Redevelopment of the Town Centre also provides an opportunity to increase the diversity of housing choices in an area close to services, shops, jobs and transit.”

There has been solid growth of residential development over the past several years, though future inventory remains low given the lack of land for development coupled with the District of North Vancouver’s more recent efforts to slow new development.

The Policy Background

The District of North Vancouver created a new Official Community Plan (“OCP”) in 2011, and the land use objective for Lynn Valley Town Centre was to “accommodate approximately 2,500 new units” over a twenty year time horizon.

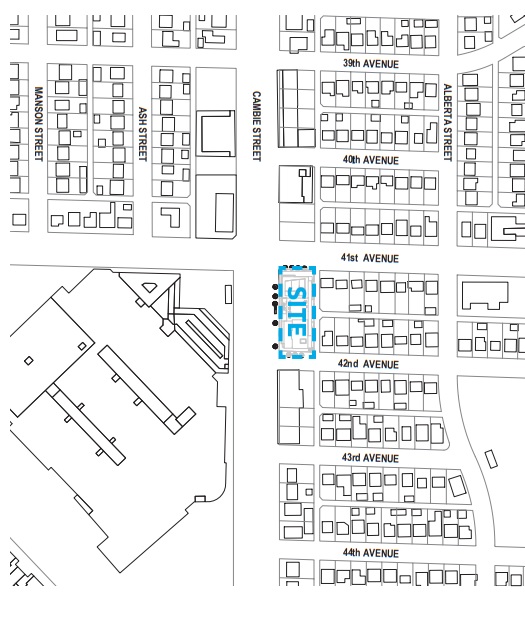

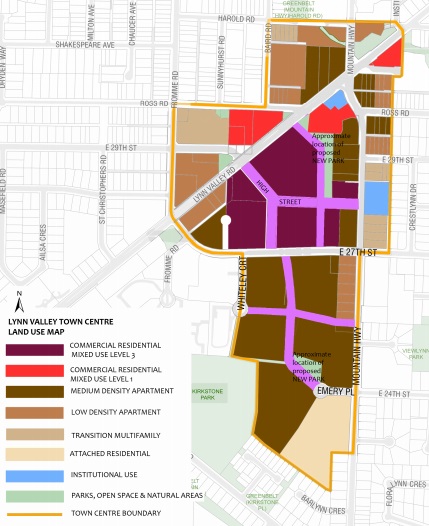

The OCP was further refined for Lynn Valley in 2013/2014 and opened up a number of development opportunities, but confined these opportunities to primarily the relatively small area between Mountain Highway and Lynn Valley Road.

A number of development projects have been initiated or completed (this is expanded upon below).

The rezoning designations contemplate mostly low to medium density woodframe residential except on key sites including the Lynn Valley Centre Mall site, which were given higher density designations. There are only a handful of properties with a commercial only designation.

Here is a video outlining the overall urban design/public realm concept:

Lynn Valley Centre mall was determined to be a focal point of the plan area. The 12-acre shopping centre was acquired by Bosa Development in 2003 for $36,000,000, or an 8.6% cap rate and subsequently rezoned in 2014 (further details below). The adjacent 2.8 acre Safeway site is separately owned by Crombie REIT.

As with the other growth centres in the District of North Vancouver, the appearance of rapid growth and attendant impacts such as traffic and construction has led to increasing opposition for new rezoning applications. The District of North Vancouver is now undertaking a lengthy review of their OCP to determine what adjustments need to be made to keep growth under control and to deliver on promises of affordability.

The Residential Market

Traditionally Lynn Valley has been a single family and ground-oriented community/submarket. Some older lowrise condo buildings exist on side streets near the mall site. The vast majority of condo product in Lynn Valley has been built in the Town Centre area in the last 15 years, mostly as a result of the new OCP in 2011.

The lack of condo buildings in Lynn Valley has generally supported increased pricing, particularly given price points relative to single family, which can reach well in excess of $2 Million for new product.

Here is a snapshot of the currently active condo listings on MLS:

| # of Active Condo Listings | 10 |

| Median Sale Price | $620,000 |

| Median Age (years) | 10 |

| Median $/SF (All) | $766 |

| Median $/SF (2yrs old or newer) | $881 |

Older woodframe condos typically trade in the $500-600 per SF range, with newer concrete condos in the $850-950 per SF range.

Recently completed projects include:

Polygon’s 68-unit Juniper at 2517 Mountain Highway. It is woodframe construction. Completed in 2019. Recent resales show values of $825-850 per SF. Taluswood has been another successful subsequent phase nearing completion across Library Lane.

Bosa’s first phase of the Residences at Lynn Valley included a 108-unit, 7-storey concrete building on the Eastern portion of the Mall site. It was completed in 2018. Resales values range from $750-1,000 per SF.

Walter’s Place is a 35-unit woodframe building by Milori Homes, completed in 2017. Recent resales figures show values of $800-850 per SF.

Canyon Springs is another Polygon project just down the street, completed in 2015. 108-units and also woodframe, recent resales show a range of $750-850 per SF.

Overall, about 800 units have been built in Lynn Valley since the OCP was adopted, and most of these have now been sold.

New Construction & Proposed Units

Phases 2 and 3 of Residences at Lynn Valley are nearing completion. These terraced buildings up to 12-storeys in height total an additional 250 units.

Approximately 400 units are in the proposal stage for Lynn Valley, the largest of which is Mosaic Homes’ Emery Village project, just South of Lynn Valley Centre, which contemplates 327 condo units and 84 rental units in a phased development. The District approved rezoning in 2018 and development permit for the first phases in 2019.

Rental

The District of North Vancouver has a total inventory of only approximately 1,200 units of purpose built rental units, and less than a quarter of these are located in Lynn Valley (excluding Seniors’ residences which number several hundred more).

Polygon Homes recently completed Hawthorne at Timber Court, a 75-unit woodframe rental apartment building located adjacent their Juniper project. The Hawthorne building is taking registrations for lease, and has also recently been listed for sale.

The Land Market

After completion of the OCP and amid a rising residential real estate market, a number of larger development sites have transacted over the past five years as the market has continually justfied redevelopment of older lowrise apartment properties on relatively underutilized sites. Some of these include:

Mountain Court, this 4.1 acre site housed 72 older rental units and was acquired by Polygon in 2015 for what would eventually become Timber Court (Juniper, Hawthorne & Talisman). The $25,640,000 price tag equated to approximately $80 per buildable SF.

Mosaic Homes acquired the aforementioned 5.1 acre Emery Village site in 2016 for $39,550,000 or $75 per buildable SF.

In 2017, Headwater Projects acquired a 16,920 SF site at 1149 Lynn Valley Road for $5,000,000 or $169 per buildable SF. A 2018 rezoning application anticipated a 36-unit condo project at 1.75 FAR, though the site has recently been listed for sale for $6,800,000 or $230 per buildable SF.

The Commercial Market

There is currently approximately 300,000 SF of commercial space in the Lynn Valley Town Centre area, over half of which (170,000 SF) is in the Lynn Valley Centre mall. There have not been any significant recent investment transactions in the area.