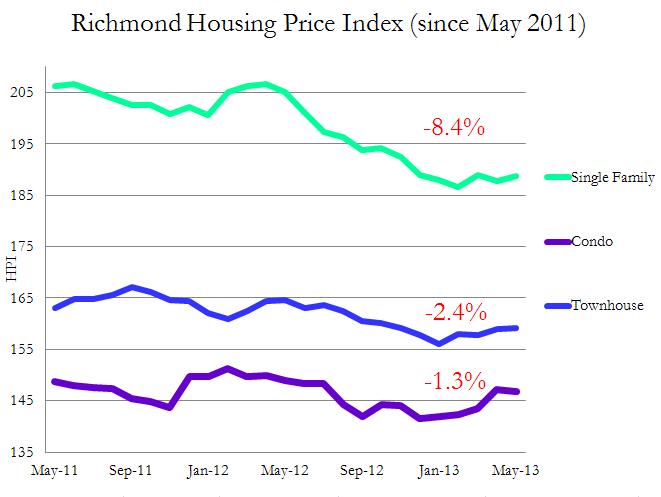

Based upon the most recent statistics from the Real Estate Board of Greater Vancouver’s Home Price Index, benchmark prices for Richmond residential properties have shown minor gains since the beginning of 2013 after a long period of negative or stagnant growth in pricing.

Click above for greater detail.

Source: REBGV stats. (The home price index measures the rate of change on housing prices based on resales data to obtain benchmark prices.)

For perspective, the benchmark price for single family has declined 8.4% since the peak in June 2011. After a dramatic rise in 2010, prices now sit roughly at February 2011 levels. Condos and townhouses prices have shown recent gains after a couple of years of slow or zero growth.

From a new supply perspective, there are currently estimated to be approx. 5,000 housing units under various stages of approval and development in Richmond (ie. 1-5 years delivery), most of which are either woodframe or concrete multifamily units. New townhouse construction comprises less than 7.0% of the total new units being built. New single family construction in Richmond is currently limited to small scale and single lot developments.