Top 10 Land Deals of 2019

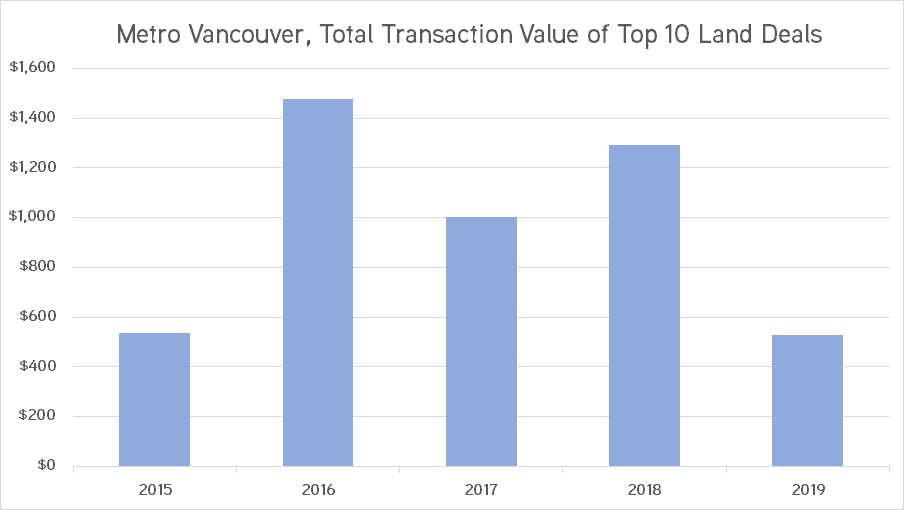

The cooling off started in early 2018, but 2019 land sales data in Metro Vancouver shows the extent of the slowdown.

After a seemingly unstoppable run up in values and transaction activity over the past five years, both prices and number of sales have declined.

After a record 2018 for land sales in Metro Vancouver with $5 Billion in total sales value, the total value for 2019 was down more than half, to $2.4 Billion.

Declines have been offset by continued strength in demand for rental residential and office development. Likewise, more recent activity suggests a return of demand for condo land in the suburbs. Conversely, core luxury condo sites have essentially fallen off the radar.

Here’s a look at each of the 10 largest land deals of 2019:

1. Lougheed & Alpha, Burnaby

- Price: Approx. $250 M

- Site Area: 7.86 acres

- Vendor: Private Owner

- Purchaser: Grosvenor

The goods: The largest land deal of the year took place in the rapidly transforming Brentwood Town Centre area of Burnaby. The site in question represents a land assembly of auto dealership land and an office building to total a combined 8 acres (some of which already owned by Grosvenor) located at the corner of Lougheed Highway and Alpha Avenue, across the street from Shape’s Amazing Brentwood project, now under construction. The deal closed in October 2019 and represents a long-term redevelopment for Grosvenor.

A rezoning application has now been submitted by Perkins + Will Architects that would establish a master plan for the site. The development plan envisions a high density mixed-use development with condos, rental apartments, retail and office space.

2. 331 Riverside Drive, North Vancouver

- Price: $55 Million

- Site Area: 3.7 acres

- Vendor: Private Investor

- Purchaser: Darwin Construction & Quadreal

The goods: This 3.7-acre site is located in the Maplewood Village area of North Vancouver. The property is currently improved with older lowrise apartment buildings but is designated to allow rezoning for a medium density residential development up to a density of 2.50 FAR. There is currently no timeframe for redevelopment.

3. Plaza 102 Site, Surrey

- Price: $54 Million

- Site Area: 1.6 acres

- Vendor: Private Investor

- Purchaser: Private Investor

The goods: This strip mall is located at the corner of 102 Ave and King George Boulevard in the City Centre area of Surrey. The site is directly across 102 from Central City.

There is no word yet on redevelopment, but the City Centre Plan allows for a high density redevelopment up to 7.50 FAR.

4. 18930 & 18970 24th Avenue, Surrey

- Price: $44 Million

- Site Area: 20 Acres

- Vendor: Private Investor

- Purchaser: PIRET

The goods: This sale involved a large industrial site in the Latimer area of Campbell Heights in South Surrey. An initial rezoning application anticipates rezoning the combined site to allow a new industrial building. Blackstone Property Partners took Pure Industrial (“PIRET”) private in May 2018.

5. 3231 No. 6 Road, Richmond

- Price: $42 Million

- Site Area: 9.5 acres

- Vendor: Kingsett Capital

- Purchaser: Conwest Group

The goods: Conwest acquired this industrial property, previously occupied by Versacold, in November 2019. The plan includes redevelopment.

6. 4275 Grange Street, Burnaby

- Price: $38 Million

- Site Area: 1.1 acres

- Vendor: Strata

- Purchaser: Qualex Landmark

The goods: Another tower site in the coveted Metrotown area of Burnaby, this assembly of a strata building was completed by Casey Weeks and Morgan Iannone of Colliers in early 2019. Rezoning details have not been released yet, but the OCP allows a highrise tower.

7. Burke Mountain Site, Coquitlam

- Price: $35 Million

- Site Area: 9 acres

- Vendor: City of Coquitlam

- Purchaser: Polygon

The goods: This 9 acre low density residential site in the Partington Creek area of Burke Mountain was sold by the City of Coquitlam to Polygon. After the sale, a development proposal has been submitted which includes 132 townhouse units.

8. 465 East Broadway, Vancouver

- Price: $33 Million

- Site Area: 0.9 acres

- Vendor: Private Investor

- Purchaser: Reliance Properties & Kingsett

The goods: This site was sold by the Colliers team of Oliver Omi and Casey Pollard in April 2019. The site was sold via off-market transaction and includes an older lowrise commercial building. The site is zoned C-2 which allows outright approval for 4-storeys.

9. 3006-3060 Spring Street, Port Moody

- Price: $33 Million

- Site Area: 2.3 acres

- Vendor: Private Investor

- Purchaser: PCI Group

The goods: This site is currently an older industrial property, but has significant rezoning potential under the City of Port Moody’s OCP.

10. 6425 Silver Avenue, Burnaby

- Price: $31 Million

- Site Area: 0.74 acres

- Vendor: Private Local Investors

- Purchaser: Kunyuan International

The goods: This property is designated for high density residential development and includes a 48-unit lowrise apartment building.

Some notes from the above list:

- Only 1 of the 10 largest land deals in Metro Vancouver took place in the City of Vancouver (down from 4 of 10 last year, and 9 out of 10 in 2017)

- 5 of 10 were sold by market bid process (the other 2 were ‘off-market’)

- 8 of 10 were bought by well-established ‘local’ development groups, the other buyers were offshore or ‘new-entrant’ development companies.

Have a question or a comment on the above? Feel free to contact me.