STELLARTON, N.S. — Empire Company Ltd. announced a plan Wednesday to sell 68 Safeway properties in a sale-leaseback deal with Crombie REIT for $990 million in cash.

The company, which owns the country’s second-largest grocer Sobeys Inc., said the properties involved in the sale are located in British Columbia, Alberta, Saskatchewan and Manitoba.

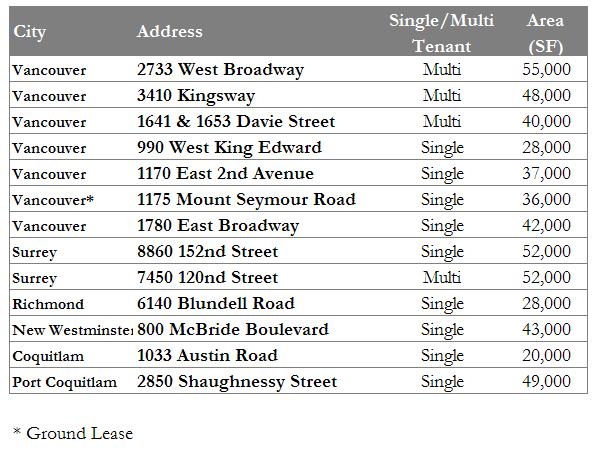

Metro Vancouver Properties Sold:

In early June, Empire signed an agreement to buy more than 200 grocery stores from Canada Safeway Ltd. in a $5.8-billion deal. At the time, it said that it intended to finance the acquisition with a $1 billion sale-leaseback that it would first offer to Crombie REIT.

“We are pleased to announce this sale leaseback transaction between Sobeys and Crombie REIT,” Empire president and chief executive Paul Sobey said in a statement.

“The sale proceeds will be used by Sobeys to assist in the funding of the Canada Safeway acquisition which provides Sobeys with a much stronger presence in Western Canada and allows them to benefit from increased economies of scale.”