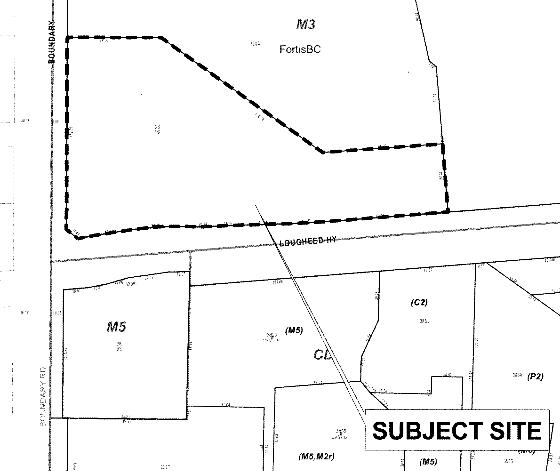

A rezoning proposal has been put forward to develop a phased commercial development at 2020 Boundary Road, a site the Northeast corner of Lougheed and Boundary Road in Burnaby. Translink sold the site last year to the Open Road Auto Group for $19.2 Million.

The development will consist of:

- two or three high-end auto dealerships

- a 4-storey fully enclosed glass structured car parkade

- an 8-storey, 85,000 SF office building with underground parking and grade level retail uses

- a total density of 0.77 FAR

The auto dealerships are proposed to be the first phase of the development, with the commercial uses later.