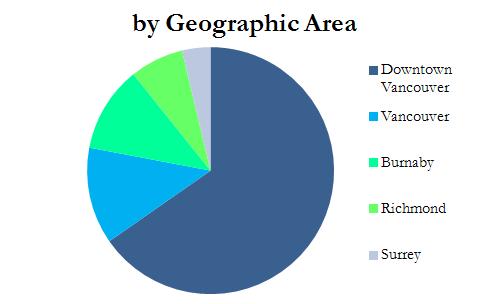

With a couple of high-profile apartment buildings trading last year (notably, Lougheed Village and the strata-titled Pacific Point), here’s a look at Vancouver’s most valuable market-rental apartment properties in Metro Vancouver.

The top-10 list has been compiled based upon total assessed values, and excludes strata titled, co-op or non-freehold properties.

1. Langara Gardens, 501 West 57th Avenue ($164 Million) This 621-unit complex consists of four towers and multiple townhouse buildings and sits on a strategically located 21 acre site at Cambie and 57th. The property was developed in the 1960’s and expanded with a fourth tower in 1988. The property also includes some retail units on West 57th. Langara Gardens was sold by the well-known Wosk family in 2009 to Ben Yeung’s Petersen group for $157 Million, representing a 4.3% cap rate. This acquisition, a Vancouver record, is increasingly looking like a great move for Petersen, with significant redevelopment potential on this sizeable lot.

1. Langara Gardens, 501 West 57th Avenue ($164 Million) This 621-unit complex consists of four towers and multiple townhouse buildings and sits on a strategically located 21 acre site at Cambie and 57th. The property was developed in the 1960’s and expanded with a fourth tower in 1988. The property also includes some retail units on West 57th. Langara Gardens was sold by the well-known Wosk family in 2009 to Ben Yeung’s Petersen group for $157 Million, representing a 4.3% cap rate. This acquisition, a Vancouver record, is increasingly looking like a great move for Petersen, with significant redevelopment potential on this sizeable lot.

2. Metropolitan Towers, 930 Seymour ($111 Million) This 437-unit, 2-tower complex located at Seymour and Nelson in Downtown Vancouver was completed by Wall Financial in 2002. It includes a Nester’s grocery store on the ground floor. Since it’s completion over ten years ago, a number of projects have been completed in close proximity, including by Wall at Capitol Residences. Metropolitan Towers offers a relatively affordable alternative to rentals in many of the newer condo projects.

2. Metropolitan Towers, 930 Seymour ($111 Million) This 437-unit, 2-tower complex located at Seymour and Nelson in Downtown Vancouver was completed by Wall Financial in 2002. It includes a Nester’s grocery store on the ground floor. Since it’s completion over ten years ago, a number of projects have been completed in close proximity, including by Wall at Capitol Residences. Metropolitan Towers offers a relatively affordable alternative to rentals in many of the newer condo projects.

3. Beach Towers, 1600 Beach Avenue ($96 Million) Beach Towers is a 4-tower, 598 unit complex located front and centre on English Bay in the West End. Also sold by Colliers for the Wosk family in 2009 as part of their portfolio disposition. The towers were sold for $117 Million to a group led by Devonshire Properties. The price represented a 4.0% cap rate and $195,000 per unit. Devonshire is currently seeking to use some of the residual density on the site for more rental units.

3. Beach Towers, 1600 Beach Avenue ($96 Million) Beach Towers is a 4-tower, 598 unit complex located front and centre on English Bay in the West End. Also sold by Colliers for the Wosk family in 2009 as part of their portfolio disposition. The towers were sold for $117 Million to a group led by Devonshire Properties. The price represented a 4.0% cap rate and $195,000 per unit. Devonshire is currently seeking to use some of the residual density on the site for more rental units.

4. Bayview, 1529 West Pender Street ($85 Million) This 236-unit, 28-storey tower prominently featured at the intersection of West Pender and West Georgia in Coal Harbour was completed by bcIMC in 2002. After 10 years, the building remains one of the highest quality purpose-built rental buildings in Vancouver.

4. Bayview, 1529 West Pender Street ($85 Million) This 236-unit, 28-storey tower prominently featured at the intersection of West Pender and West Georgia in Coal Harbour was completed by bcIMC in 2002. After 10 years, the building remains one of the highest quality purpose-built rental buildings in Vancouver.

5. Lougheed Village, 9500 Erickson Drive ($78 Million)  Lougheed Village is a two-tower, multiple lowrise, 548-unit complex in the Lougheed area of Burnaby. The property sold to Mayfair Properties in April of last year for $90 Million, or $164,000 per unit. Built in 1973, the property currently produces $7,400,000 in gross income per year and sits on 7.5 acres of land.

Lougheed Village is a two-tower, multiple lowrise, 548-unit complex in the Lougheed area of Burnaby. The property sold to Mayfair Properties in April of last year for $90 Million, or $164,000 per unit. Built in 1973, the property currently produces $7,400,000 in gross income per year and sits on 7.5 acres of land.

5-10:

6. McKenzie House, 5775 Toronto Road, UBC ($70 Million)

7. Columbia Place, 1150 Jervis Street, West End ($66 Million)

8. Pacific Palisades, 788 Jervis Street, West End ($64 Million)

9. Carmana Plaza, 1128 Albernie Street, West End ($63 Million)

10. Ocean Towers, 1835 Morton Avenue, West End ($62 Million)

Honourable Mention: Here’s a few that were not included for various reasons:

- Park Royal Towers. This 505 unit complex is one of Vancouver’s larger apartment assets, valued at $147 Million, though it is on leased land with the Squamish First Nation.

- Pacific Point. This 227-unit strata titled complex sold in 2012 for $79 Million and has an assessment of over $70 Million

- Panorama Place, a 147-unit co-op is valued at over $72 Million.

Coming soon: a look at neighbourhoods with the most expensive apartments on a price per unit basis.