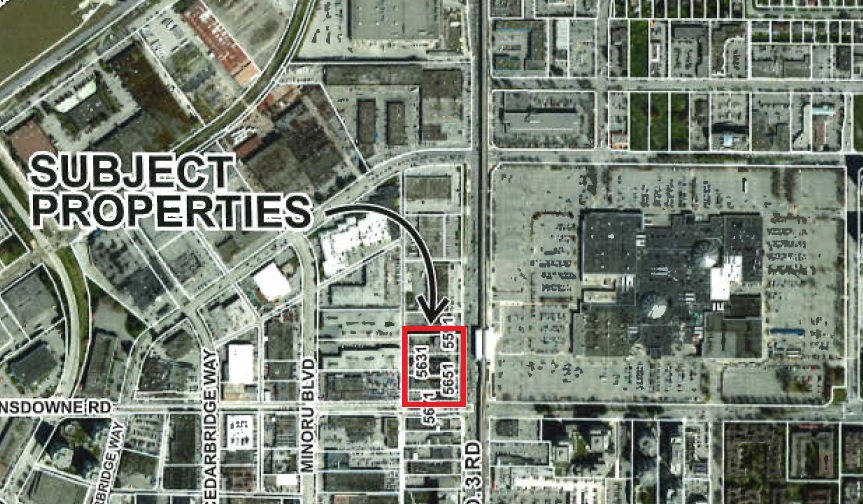

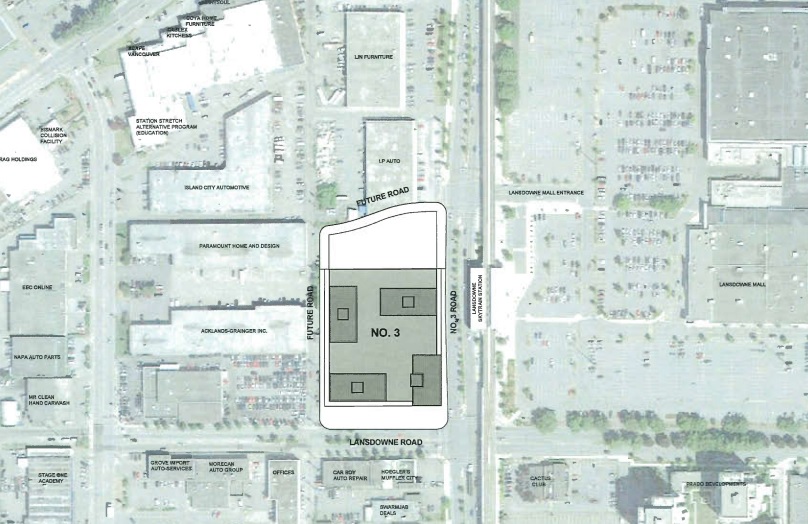

Townline has applied to the City of Richmond for permission to rezone a 97,400 SF site on the west side of No 3 Road in Richmond. The assembly of four lots is located at the corner of Lansdowne Road, across from Lansdowne Centre. The lots are improved with older lowrise commercial buildings including the Milan Ilich Arthritis Research Centre. The site sits directly South of another large scale rezoning proposal currently in the latter stages of approval, named ‘Atmosphere‘, and directly across from the Lansdowne Canada Line Station.

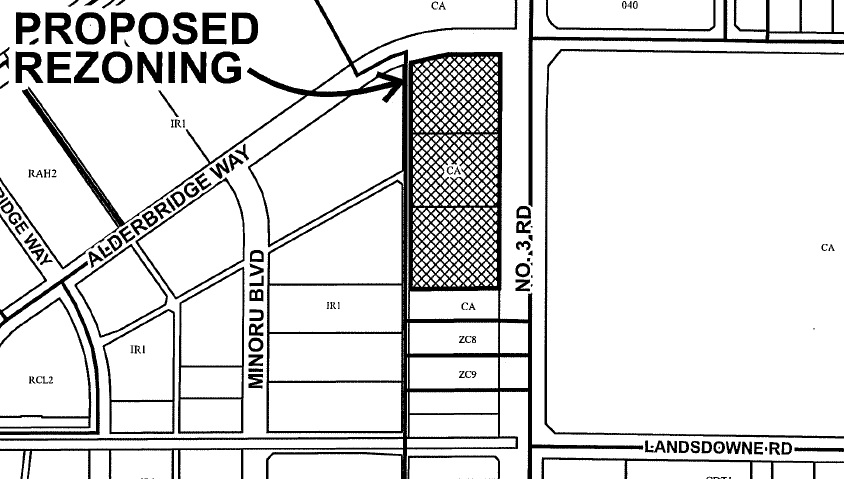

The proposal calls to rezone the properties at 5591,5631,5651 and 5671 No.3 Road to “High Density Mixed Use – Lansdowne Village (City Centre)” in order to permit a high-density commercial, office and residential use development.

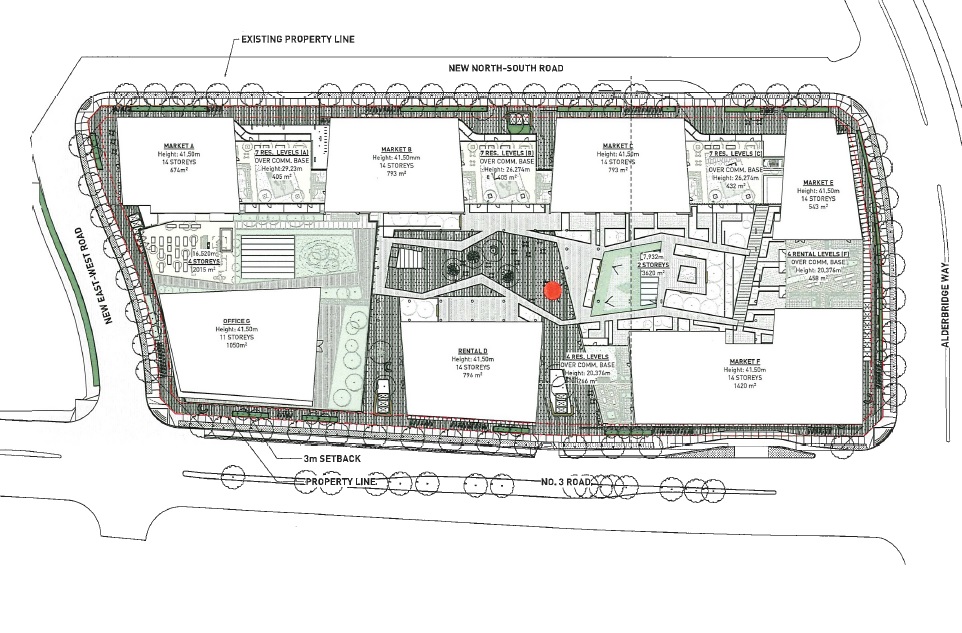

The proposal is for a new mixed use development comprised of a podium and tower form of development with below and above grade parking, ground level commercial, a signature 12-storey office tower and three 10-storey residential towers.

Details include:

- 365 residential units;

- 354 condos;

- 20 affordable housing units (low end market rental);

- 19,279 SF of retail space on the ground level;

- 77,740 SF of office space;

- a total density of 4.0 FAR;

- A 6,000 SF on-site community facility;

- Dedication for new north-south road on West side of site;

- Design, construction and transfer to the City of the area of the site designated for the Lansdowne linear park;

- 548 parking spaces (below and above grade).

The architect for the project is Musson Cattell Mackey Partnership.

The architect for the project is Musson Cattell Mackey Partnership.