Next week, City of Vancouver Council will consider a report from the Engineering and Planning Departments seeking to approve a new City-wide utilities development cost levy (DCL) and a long term capital projects program for upgrades. The report also confirms the Utilities Servicing Plan for the Cambie Corridor Phase 3 area and the CAC target rates for the Cambie Corridor and Marpole areas.

Here is a summary of these new recommendations.

New Utilities DCL

The need for infrastructure upgrades was highlighted during the latter stages of the Cambie Phase 3 planning in which significant new density was introduced in the Oakridge Transit Centre area in plans laid out in 2017. A reassessment of the future demand on sewer, drainage and water service capacity has led to this city-wide strategy. The City is now looking at increasing DCL rates to help finance the servicing requirements across multiple developments rather than piggybacking off of the initial developments in certain areas.

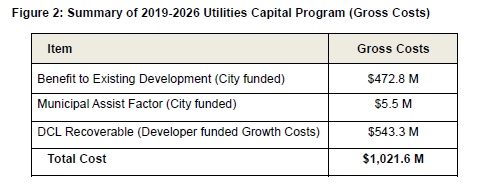

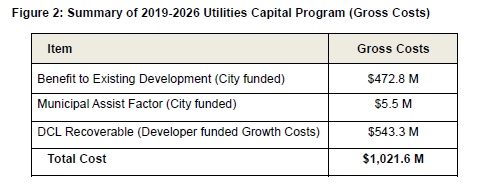

The recommended new DCL framework for financing water, sewer and drainage utilities

upgrades includes a long-term capital program of approximately $1 Billion and the introduction of a dedicated City-wide Utilities DCL to cover approximately $547 Million of that cost (benefit to new development) through DCL’s by 2026.

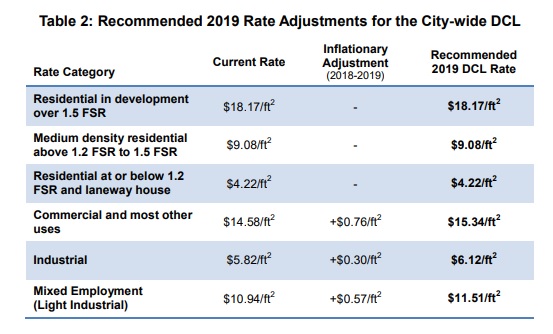

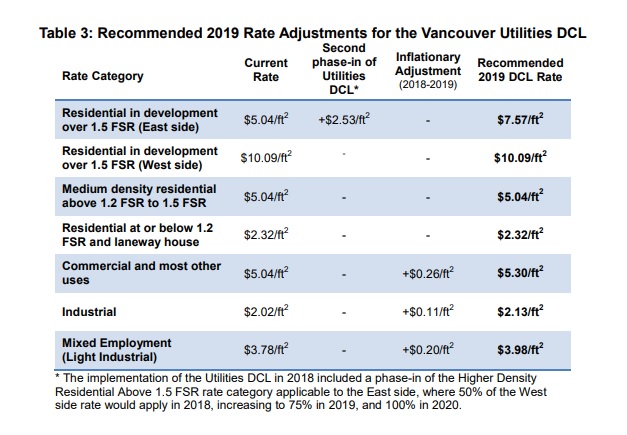

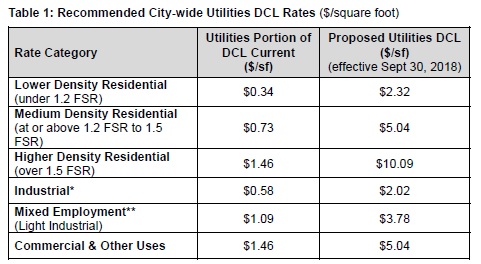

Currently, utilities are embedded in the overall City-wide DCL rates, but the utilities component will now be separated in order to “improve transparency and certainty for developers.”

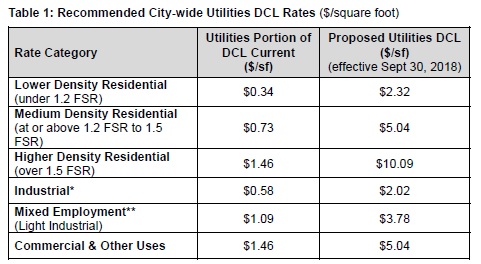

The report highlights the utilities portion of current DCL and the proposed Utilities DCL to demonstrate the increased rates:

Interestingly, a background study by Coriolis Consulting noted the following (from report):

- New residential development downtown and on the west side of the city could

accommodate the proposed rate increases.

- New residential development on the east side of the city has less ability to absorb

the new DCL costs without impacting economic feasibility.

- For new non-residential development, Coriolis found in last year’s DCL report to the City that an increased DCL rate would have a negative impact on sites that are currently viable for redevelopment. For new industrial development, it would be challenging for most projects to support any increase in DCL rates given the

inherent challenging economics. Similarly, it would also be challenging for most new office development to support an increased DCL rate.

- In all cases where there is a DCL rate increase, it is preferable to phase-in the rate increase so new development can adjust to the increased costs.

The report also recommends that the Utilities DCL be waived for market rental housing (Most rental rezonings are eligible for DCL waiver) on an interim basis until 2020 with a review by staff coming next year.

The new DCL rates will come into effect on September 30, 2018 (rates are protected for in-stream applications for one year from the effective date).

Utilities Servicing Plan for Cambie Corridor & CAC Rates

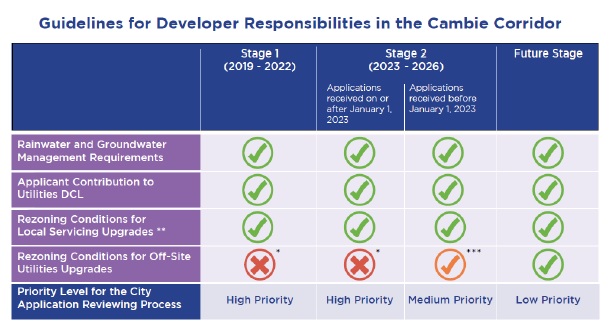

The City approved the Cambie Corridor Phase 3 Plan at council in May, though the land use plan has remained subject to a pending Utilities Servicing Plan, which intends to lay out the development sequence of sites based upon utilities upgrades.

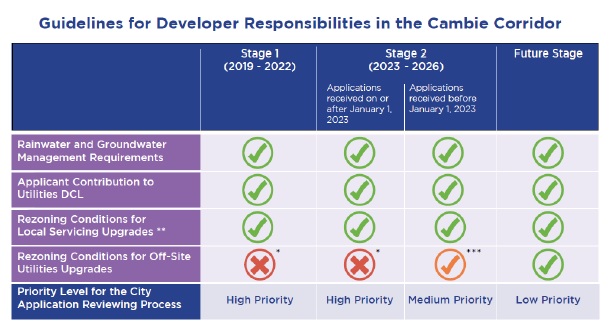

Highlights of the plan include:

- City-initiated rezoning (“prezoning”) of townhouse areas in Stage 1 in the

short-term (anticipated for referral and public hearing in summer/fall of 2018)

- Requirement for basic onsite rainwater and groundwater management

Here is a guideline for development in the Cambie Phase 3 area:

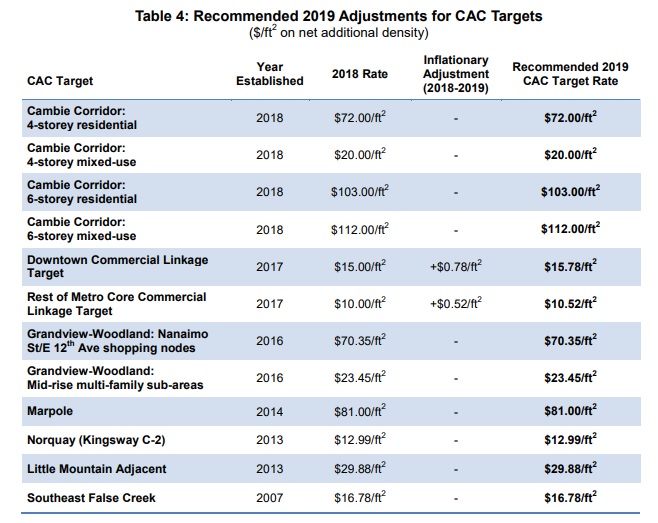

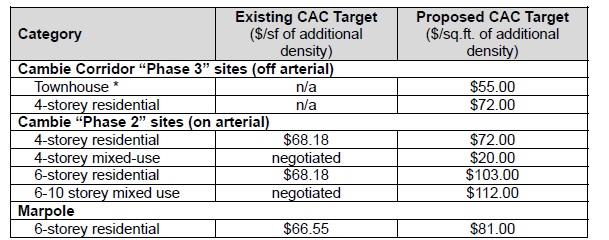

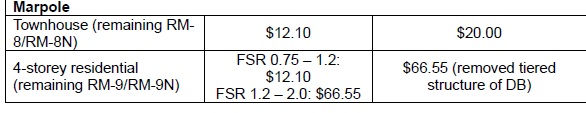

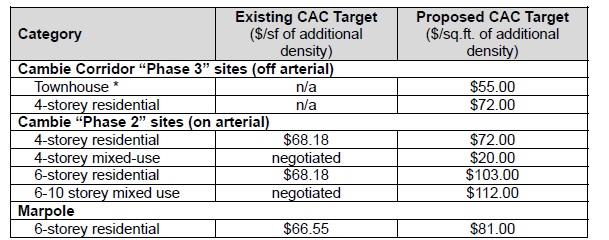

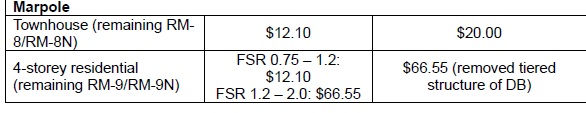

Lastly, here are the proposed new CAC target rates for the Cambie Corridor and Marpole Areas:

Cambie Corridor

Marpole

The full report can be viewed here: https://council.vancouver.ca/20180711/documents/cfsc1.pdf