The land market in Metro Vancouver cooled considerably in 2023, following a very active two year stretch between 2021-2022. The slowdown in transaction activity began in early 2022 and really took hold heading into this year.

Increasing interest rates and stubbornly high construction costs proved challenging in putting together land deals, particularly for larger sites.

Nevertheless, most participants in our market continue to have an optimistic outlook on economic and demographic fundamentals and those that are well capitalized will continue to be in a strong position to acquire good sites.

In the short term, it appears that land deals in the $15-50 Million range are in the ‘sweet spot’ in our market – large enough to meet the scale requirements of larger pension fund and private equity investors, though small enough to execute, finance and build in a single phase.

Here’s a look at each of the 10 largest land deals in Metro Vancouver this year:

1. 1145 Inlet Street, Coquitlam

- Price: $111 Million

- Site Area: 8 acres

- Vendor: Private

- Purchaser: Ledingham McAllister

The goods: This 1980’s era rental townhouse complex in the City Centre area of Coquitlam was acquired by Ledingham McAllister to realize signficant development upside. A rezoning application for the site envisions over 1,100 units in 9 highrise and lowrise buildings, all comprising a project entitled “Stratford Wynd“.

The draft master plan and implementation strategy for the site will be prepared in Spring 2024, and City Council will review the master plan and implementation strategy for approval in Fall 2024. The project will be built in phases.

2. 5502 Lougheed Highway, Burnaby

- Price: $94 Million

- Site Area: 4.3 Acres

- Vendor: Private

- Purchaser: Keltic Development

The goods: Keltic completed their acquisition of the Rev’s Bowling site on Lougheed Highway in early 2023. The site allows for high density residential in the City of Burnaby’s Brentwood Town Centre Plan.

A preliminary rezoning application was submitted this summer that contemplates three towers, between 50 and 60-storeys in height, with condos, affordable rental units, and retail.

The sale was brokered by Macdonald Commecial and Brett Aura of TRG.

3. 1527 Main Street, Vancouver

- Price: $80 Million

- Site Area: 1.2 acres

- Vendor: McDonald’s Canada

- Purchaser: Greystar

The goods: Completed in late November, this sale marks the beginning of an eventual redevelopment of the McDonald’s site at Main & Terminal.

The sale involves a leaseback for the restaurant and an option for a new McDonalds in the new development.

Rezoning plans have not been made public but initial indications suggest that Greystar is planning a highrise market rental project.

The sale was brokered by Brodie Henrichsen of JLL.

4. 1525 Robson Street, Vancouver

- Price: $63 Million

- Site Area: 16,400 SF

- Vendor: Private Investor

- Purchaser: GWL

The goods: Negotiated in 2022 and completed in January 2023, this deal is for a midblock highrise site on Robson Street that was rezoned in the West End Community Plan. It sits across the street from GWL’s recently completed rental project “The Chronicle” at 1500 Robson.

The site is zoned to allow for a rental residential development up to 20 storeys.

The sale was brokered by Fraser Elliott.

5. 5350-5430 Heather Street, Vancouver

- Price: $47 Million

- Site Area: 1 acre

- Vendor: Private

- Purchaser: Rize Alliance & Minto

The goods: The largest land assembly to complete this year involved five single family lots in the Oakridge Centre area, in a subarea designated to allow towers up to 18-storeys.

A subsequent rezoning application for the site contemplates two towers with 344 market and below market rental units.

The sale was completed by William Maunsell and Kelvin Luk of Luk Real Estate Group.

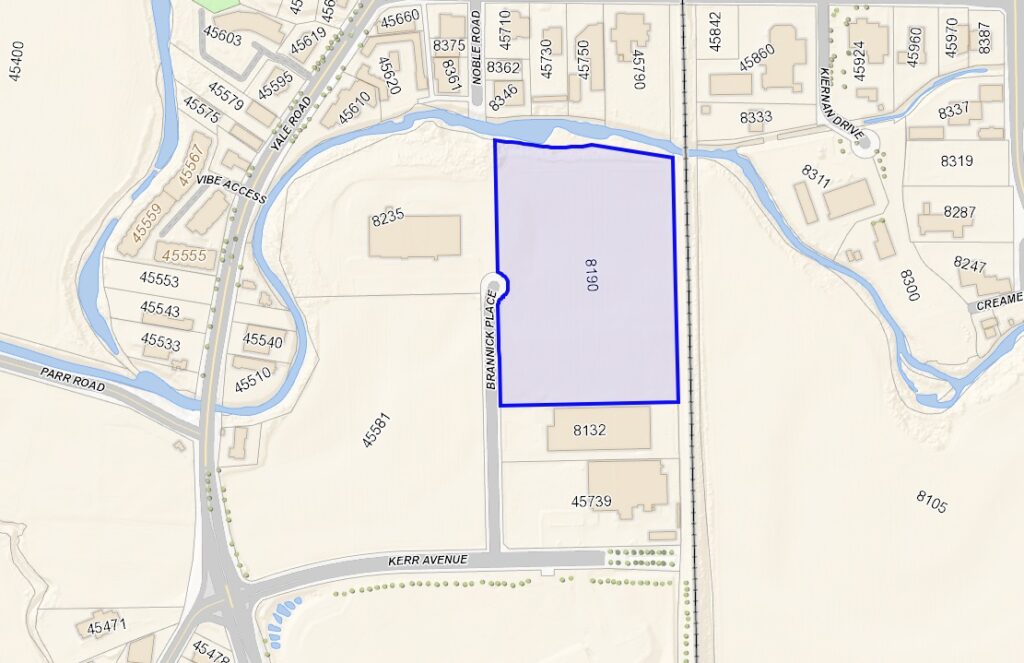

6. 8216 Brannick Place, Chilliwack

- Price: $45.7 Million

- Site Area: 15 acres

- Vendor: Private

- Purchaser: Red Bull Canada

The goods: It was announced in February that Red Bull had acquired this 15 acre site after an extensive site selection process.

Construction is expected to start on the new manufacturing facility in early 2024.

7. 119 East Cordova Street, Vancouver

- Price: $42 Million

- Site Area: 18,000 SF

- Vendor: Salvation Army

- Purchaser: BC Housing

The goods: This sale completed in May, and the Purchaser was revealed in August to be BC Housing.

A redevelopment of the site for social housing and below market housing is expected, but no formal plans or applications have been revealed.

8. 1770 West 12th Avenue, Vancouver

- Price: $41.1 Million

- Site Area: 1 acre

- Vendor: Strata

- Purchaser: Greystar

The goods: With a completion date in October 2023, this sale was one of the first sites in the Broadway Plan area to sell.

The sale represents 100% of a strata, with the listing and sale process completed by Hart Buck and Jennifer Darling of Colliers. The sale involved a 1973 built woodframe lowrise with 41 units. Redevelopment plans have not been made public, but the Broadway Plan allows for towers up to 20-storeys in this location.

9. 13631 Vulcan Way, Richmond

- Price: $40.2 Million

- Site Area: 9.5 acres

- Vendor: Private Investor

- Purchaser: Conwest

The goods: This is the second year in a row that Conwest has made the top 10 list, proving that they continue to be one of the most active industrial developers in Metro Vancouver.

Conwest completed on the sale of this Richmond industrial site in June 2023 and is now in pre-marketing the site in its first phase to be developed into 14 industrial strata units.

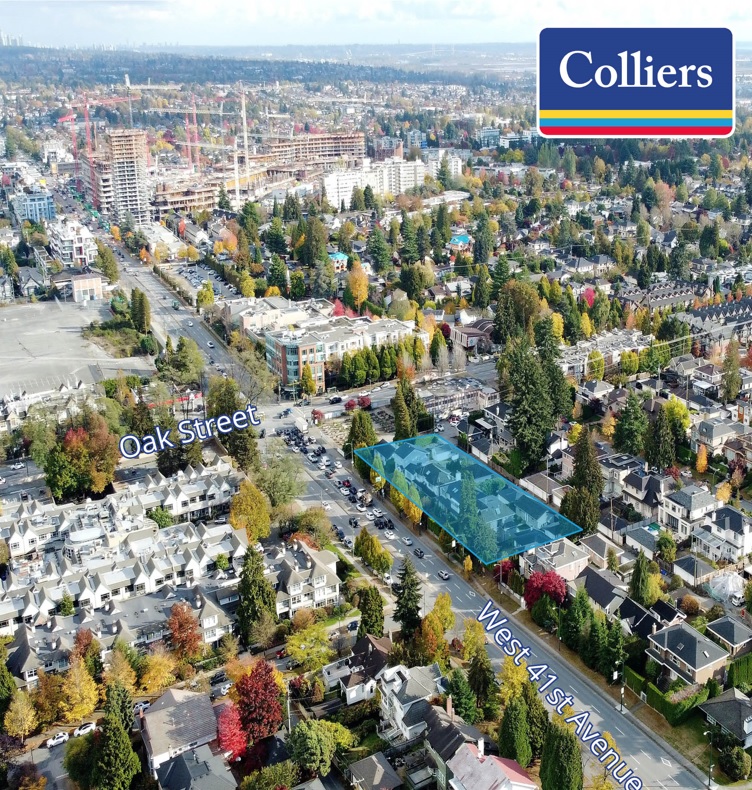

10. 1026-1108 West 41st Avenue, Vancouver

The goods: This 6-lot site was assembled and sold by myself and Charlie Hughes; completing in July 2023. Marcon submitted a rezoning application for the site in October that contemplates a 6-storey, 167 unit seniors project.

Some notes from the above list:

- 6 of the 10 largest land deals in Metro Vancouver took place in the City of Vancouver (up from 3 of 10 last year)

- 8 of 10 are residential land deals

- 6 of 10 were sold by open market bid process (the other 4 were ‘off-market’ or not openly offered)

- Aside from Red Bull, the other 9 sites were bought by well established development groups known in our market, a shift from 2016-2018 when many “new” buyers were making a splash

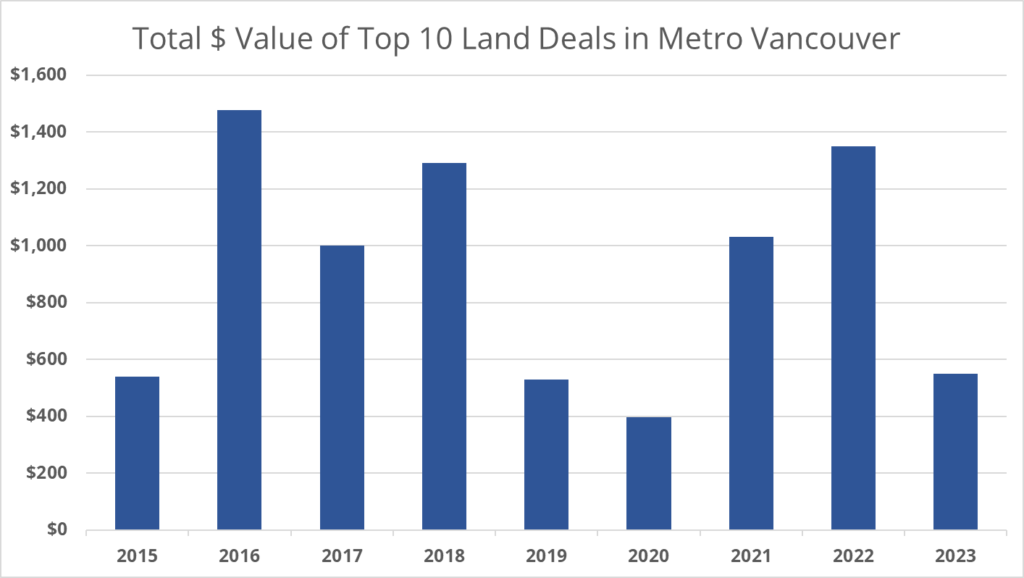

How does 2023 compare to previous years? The total dollar value for the above 10 deals is $550 Million, well below 2022 ($1.35B) and previously active years.

Here’s the ‘Top 10’ list broken down by year:

Please contact me for further information on any of the above transactions, or if any questions, comments, or corrections to the article.

Happy Holidays!