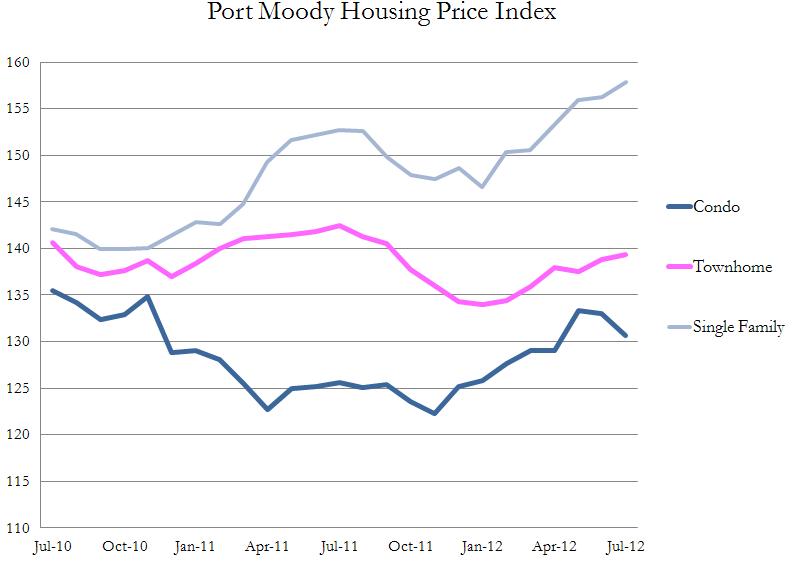

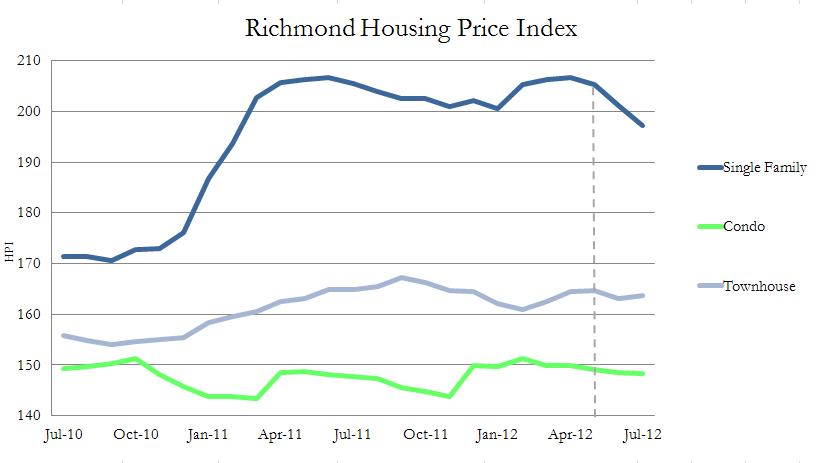

Based upon the most recent statistics from the Real Estate Board of Greater Vancouver’s Home Price Index, benchmark prices in Port Moody have remained relatively stable over the past couple of months despite a slowdown in resales activity. The benchmark price for condos has dropped 2.0% since May 2012, but townhomes and single family homes have shown an increase.

Click above for greater detail.

Source: REBGV stats. (The home price index measures the rate of change on housing prices based on resales data to obtain benchmark prices.)

For perspective, the benchmark price for single family reached a new peak in July 2012. Overall, since July 2010, single family homes prices in Port Moody have risen 11.1%, while townhouses and condos have actually declined during the same period.