By now you’ve probably seen in the media that the City of Vancouver has released an outline of the much anticipated Housing Vancouver Strategy, first announced in 2016 under then new General Manager of Planning Gil Kelley.

For those unfamiliar, the Housing Vancouver Strategy was announced as a broad City-wide planning initiative intended to address some aspects of the current housing affordability crisis. The specific policies being proposed come as a result of over a year of public and expert consultation as well as internal planning review. As the City’s report outlines, the main intent of these policies is: “to address the rampant commodification of housing and speculative demand, shift our housing toward the ‘Right Supply’, and ensure affordability, protection, and support for our most vulnerable residents.”

Perhaps not surprisingly, the Strategy will yield significant policy changes in the year leading up to the Civic Election. Notwithstanding any political motivations, from a planning perspective, the Strategy is one of the most ambitious planning programs outside of any specific neighbourhood plan, and could result in significant changes to single family areas and the low density areas around East Van transit stations and some apartment areas.

Overall the ten-year plan is intended to create:

- 72,000 new housing units, including;

- 12,000 social, supportive and co-op units

- 20,000 new purpose-built rental units

- 30,000 new condo units (incl. 1,000 laneway homes and 5,000 townhouses)

The full staff report can be downloaded here: http://council.vancouver.ca/20171128/documents/rr1.pdf

Below is a summary of the ten key policy recommendations being proposed:

- A) Shift toward the Right Supply

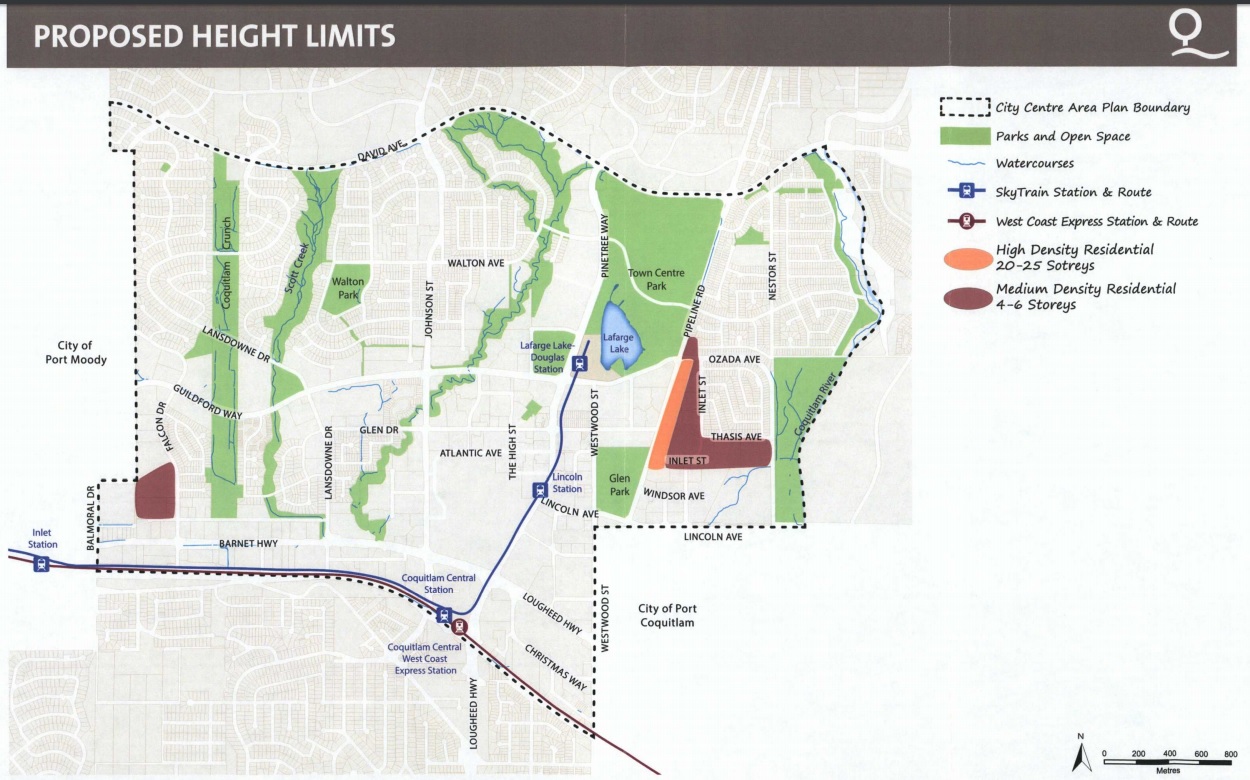

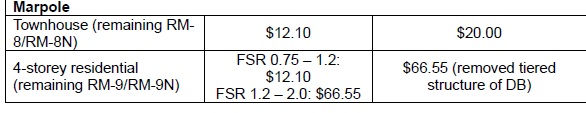

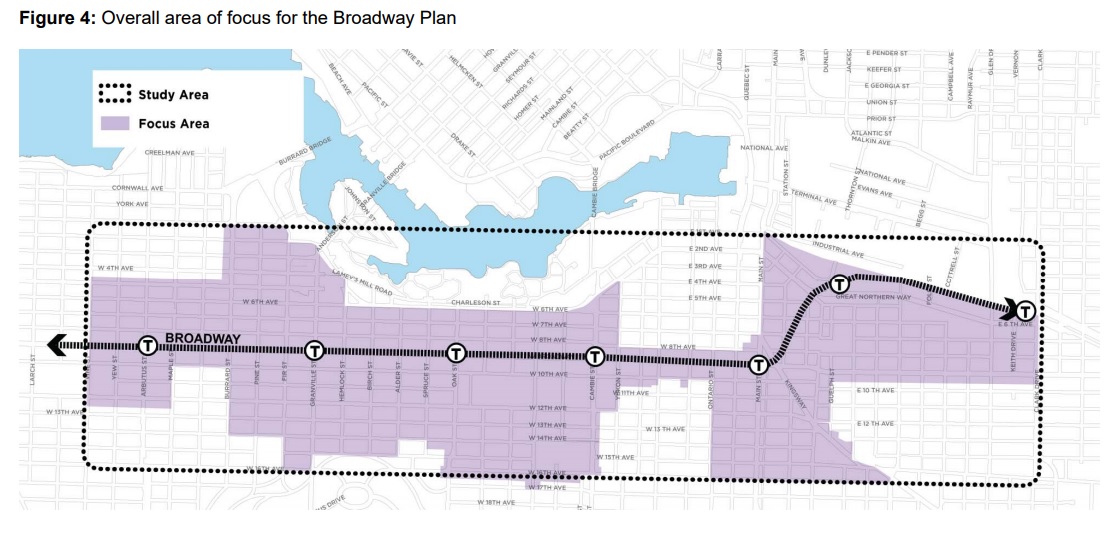

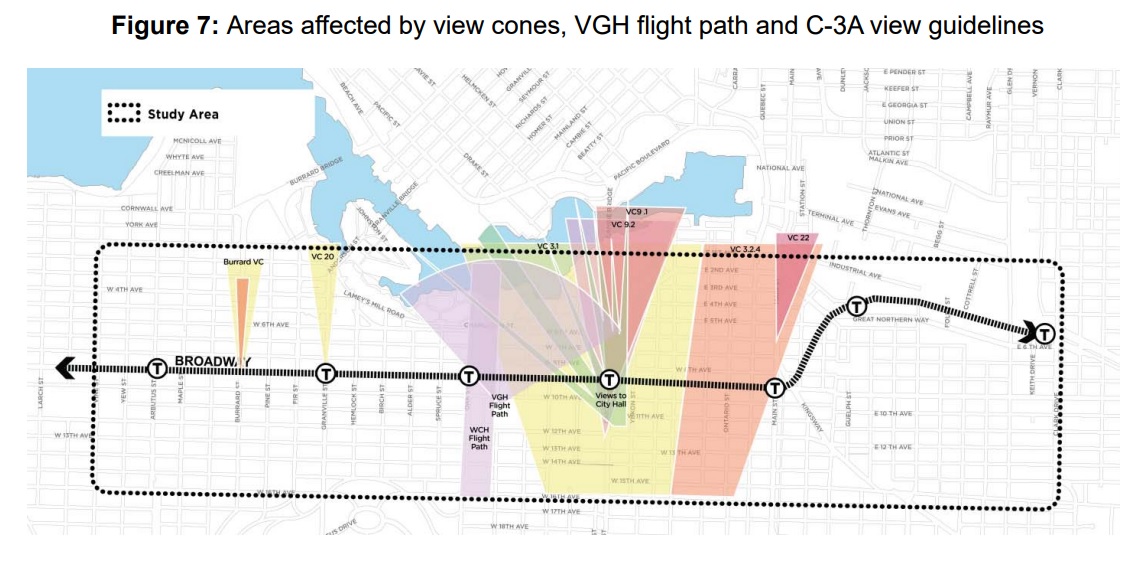

The City plan to launch major planning programs near transit hubs that don’t yet have density including: Nanaimo Station, 29th Station and Olympic Village Station. The City is also already starting a Broadway Corridor Planning Program.

This is potentially the biggest takeaway for developers, investors and those in the RE industry. The Skytrain Station announcement had been anticipated for well over two years but had yet to be formalized in a policy announcement.

B) Implement the Moderate Income Rental Housing Pilot Program

This is essentially an extension of the Rental 100 program, except further incentives would be offered to developers that include 20% of the gross floor area to “moderate income households” targeting between $30,000 and $80,000 per year.

The Pilot program will consist of 20 rezoning applications between January 2018 and July 2019.

Incentives include:

- Additional density

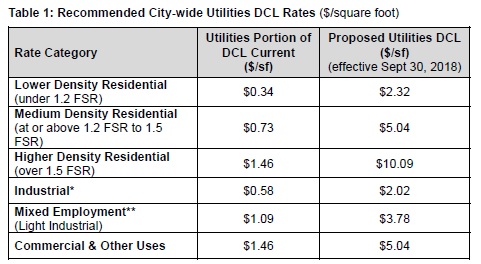

- DCL Waivers

- Access to grants and senior gov’t financial support programs

- Parking requirement deductions

- Relaxation of unit size minimums (ie. micro suites)

C) Advance the Transformation of Low Density Neighbourhoods to Increase Housing Variety

This particular policy direction has the potential to be one of the most dramatic. It could entail densification of single family areas, both near transit and in other areas. The City specifically mentions “Low density areas in the western and southern areas” as candidates for new housing. Potential options being explored include: allowing multiple dwellings in low-density neighbourhoods, including secondary suites, multiple suites, laneway housing, duplexes, triplexes, and fourplexes with secondary suites; as well as the creation of new townhouse zones).

While perhaps not as transformational in terms of density as the Nanaimo/29th/Olympic Village areas, the prospect of townhouses in areas such as Kerrisdale and Dunbar could prove the most contentious and will be interesting to watch.

TIMING: Beginning in 2018.

2. Limiting Speculative Investment – Develop a New Policy to Stabilize Land Values in Planning Programs

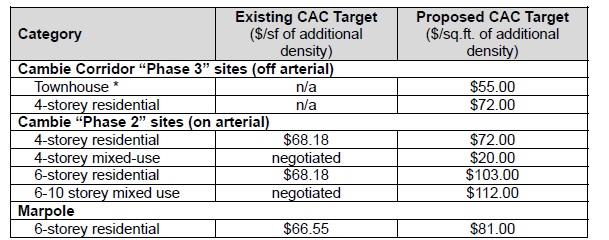

The City will seek to take quick action to limit speculation developing a new interim public benefits strategy designed to curb speculative value. The City would, for example, set the CAC target rate prior to the launch of new planning programs in an effort to curb speculative purchases. This will be tested initially as part of the Broadway Corridor Planning work.

TIMING: Beginning early 2018.

3. Develop a New 10 Year Affordable Housing Delivery and Financial Strategy

The City is going to look at how to deliver more social and supportive housing through review of various delivery and business models. These include:

- Investigating feasibility of establishing a housing endowment to

build and sustain affordable housing on a portfolio basis

- Clarifying the role and mandate of VAHA as the delivery agent for affordable housing on City land

- Leveraging senior levels of government, non-profit and private sector partners

- Specifying the partner investment and/or contribution required to meet housing

Vancouver targets for the lowest income households

TIMING: Report to Council by Spring 2018.

4. Partner in the Development a 10 Year Regional Urban Indigenous Housing Strategy

The City intends on developing a strategy to work three local first nations groups to address housing issues over a 10 year strategy plan. The strategy will include the delivery of 500-600 housing units at five properties: 950 Main, 1015 E

Hastings, 1618 E Hastings, 1607 E. Hastings, and 235-285 E 5th Avenue.

TIMING: Already underway.

5. Launch a New Social Purpose Real Estate Incentive Program

The City will also launch a new “Social Purpose Real Estate Incentive Program” to encourage development of new and redevelopment of existing non-profit housing on non-profit owned sites. The program will explore:

- Enhancing the City’s Housing Infrastructure Grant program to support affordable housing where partners, usually non-profits and co-ops, are seeking to build affordable housing on their own land

- Additional density, ownership of assets, aligning the per door grant with affordability, combined with low-cost and predictable federal and provincial financing

- Supporting the development of affordable housing on land owned by faith-based and nonprofit service organizations

TIMING: a draft strategy/policy by Fall 2018.

6. Accelerate SRO Replacement while Improving the Existing Stock to

Enhance Affordability, Livability and Supports to Tenants

The City intends on protecting the SRO stock and SRO tenants through a “two-pronged approach”:

- A goal of replacing 50% of the remaining private SROs with new self-contained social housing in 10 years.

- Improve the affordability, livability and supports for SRO tenants through: new SRO Revitalization Fund, an enforcement and regulatory approach to existing SROs and portection against further loss and displacement

TIMING: Already underway.

7: Temporary Modular Housing

The City has requested BC Housing funding for 1,200 units over the next two years, with 600 units expected to be delivered in 2018.

TIMING: Already underway.

8. Increase Rental Protections

The City has always placed emphasis on protecting existing rental stock and this has become increasingly important as rents have skyrocketed and redevelopment pressure is at an all time high.

The City will explore opportunities to redevelop existing rental housing in order

to increase the overall supply of rental housing, while prioritizing affordability and ensuring protections for existing tenants. The City will undertake a review of the Rental Housing Stock ODP and Rate of Change areas, to:

- Continue to ensure no net loss of rental units

- Reduce the threshold that triggers one-for-one replacement (e.g. from 6 to 3 units)

- Identify opportunities to redevelop and expand existing rental housing while preserving affordability

The City will also seek to enhance capacity to assist tenants with relocation needs through the creation of a new Tenant Protection Manager.

TIMING: Report to Council by Spring 2018.

9: Remove Barriers to Support Diverse Ways of Living – Enable Collective

Housing

The City says that they “heard during the Housing Vancouver engagement process that more residents are living in non-traditional housing arrangements and forms to improve affordability and help them stay in the city (e.g. collective housing, co-housing, tiny homes, live aboard boat options, etc.)”

The City is going to look at ways to increase co-housing options, as well as relaxing regulatory issues associated with non-traditional housing. Hopefully this means more inclusive zoning.

TIMING: Report to Council by Spring 2018.

10: Cutting Through the Red Tape – Simplifying and Clarifying Complicated

City Processes

If the first nine policy directions weren’t ambitious enough, this one could stick out as being dubious among interested industry and planning observers. Certainly the City’s processes for applications, permitting and consultation have become absurdly complicated and long.

The City outlines some initiatives to help tackle the overarching issues:

- a comprehensive review of City regulations

- Increase processing capacity and reduce processing times

- The City will deliver a simplified CAC policy for rezoning projects that are 100% rental

TIMING: As expected, there is no definitive timeline for this review, but it is apparently already underway.

Overall, the Housing Vancouver Strategy is fairly ambitious in that it will result in transformation of some single family neighbourhoods, likely those already near transit hubs or near existing shopping areas (think near C zones) such as Kerrisdale and Dunbar.

It is also interesting to note the extent to which land speculation has crept into policy conversation. I suspect that it will become increasingly difficult to determine land valuations prior to neighbourhood plan finalization.

A draft plan will be developed with a final round of public consultation and council consideration later this year.

A draft plan will be developed with a final round of public consultation and council consideration later this year.