Next week, City of Vancouver Council will consider an action plan to update and strengthen the City’s Heritage Conservation Program. The action plan recommends a number of “quick start” changes for immediate action, as well as more comprehensive medium and long-term changes.

Immediate Actions:

#1 – Clarify Direction on Conditional and Discretionary Zoning

The action proposed here is to make it clear that the Director of Planning and/or the Development Permit Board will not look favourably on applications seeking a conditional use or density in the zoning, where there is degradation or demolition of a heritage asset, or a property with heritage value. For example, in the C-3A zone where the outright density is 1.0 FSR, if the Property in question contains a heritage building, it will only be able to reach the conditional approval density of 3.0 FSR if the heritage resource is preserved in some fashion.

#2 – Streamline Rezoning, Development Permit and HRA Approval Processes for Heritage Retention Applications

One idea proposed is to eliminate the requirement for a review of the developer’s proforma for applications under a certain size. General administrative simplifications are also proposed.

#3 – Increase Demolition Fees for Pre-1940 Houses

A number of disincentives will be incorporated to prevent the loss of buildings constructed pre-1940, including significant increases in permit fees and waste disposal.

#4 – Solicit Senior Government Support For Rehab Tax Incentives

The City will lobby the federal government to endorse recommendations supporting heritage conservation through incentives.

#5 – Update the Vancouver Heritage Register

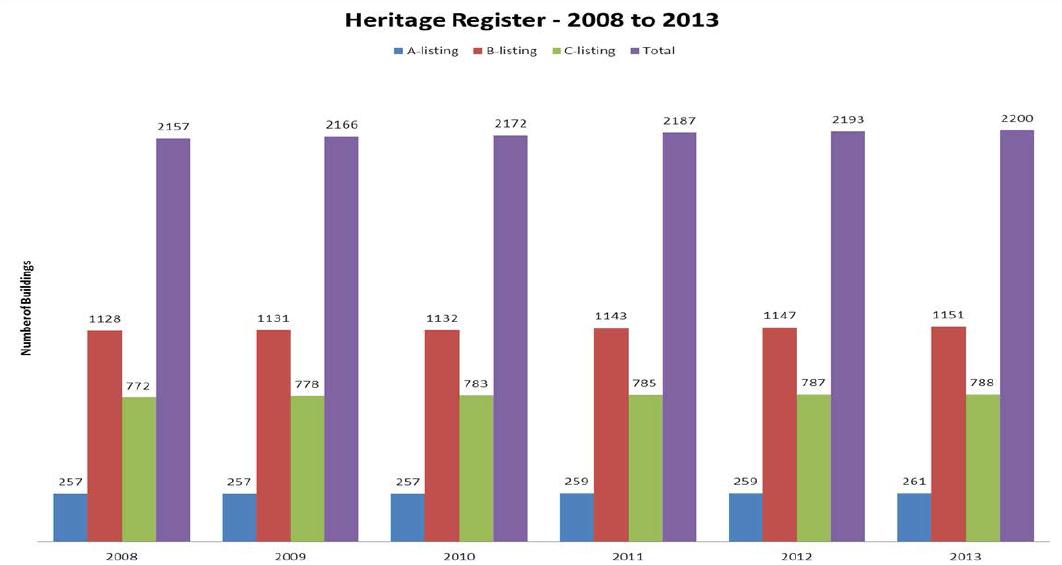

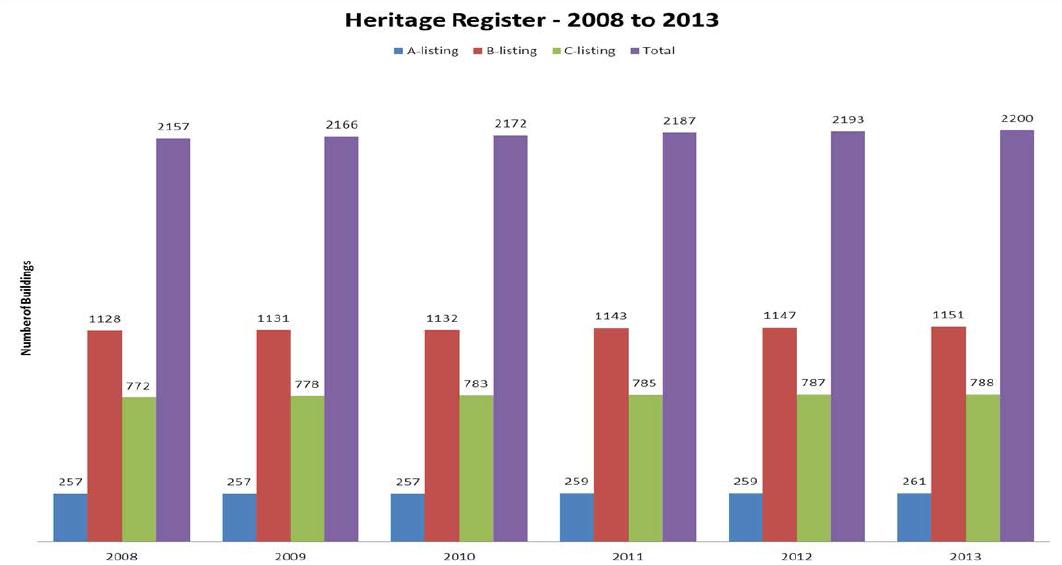

The City is proposing to update the Heritage Register over the next 18 months. As of 2013, there were a total of 2,200 buildings on the Register, with a total of 58 added over the past 6 years. Which buildings are likely targets for placement on the Register? The City is targetting themes that are presently under-represented on the Register such as First Nations sites and places with cultural and social meaning to communities (see: The Waldorf Hotel debate?)

Vancouver’s Heritage Register

Medium to Long Term Actions

#6 – Amend RS Zoning to Encourage Heritage Retention

This seeks to replicate the model in newer RT zoning by providing incentives in RS zones to preserve character and heritage buildings.

#7 – Review and Update the First Shaughnessy Official Development Plan

The idea is to address the issues of an increase in the number of demotion proposals in Shaughnessy. The City is recommending that it be changed to a Heritage Conservation Area (HCA) similar to what is common in some of Victoria’s older neighbourhoods.

#8 – Extend Existing Incentive Programs in the Downtown Eastside

Staff are recommending a two-year extension to the two incentives currently available in the DTES: the Heritage Building Rehabilitation Program (HBRP) and Heritage Facade Rehabilitation Program (HFRP).

#9 – Examine Incentive Program for Applicability Elsewhere

A general review will be undertaken to determine the applicability of heritage incentives in all areas of Vancouver. Incentives are presently limited to the DTES.

#10 – Develop an Enhanced Deconstruction Strategy

#11 – Improve Public Awareness of Amendments to Facilitate Heritage Conservation

#12 – Develop an Energy Retrofit Program for Existing Buildings

#13 – Identify Cultural Facilities in Heritage Buildings

#14 – Greater Protection of Trees and Landscapes

Source: http://former.vancouver.ca/ctyclerk/cclerk/20131204/documents/ptec8.pdf

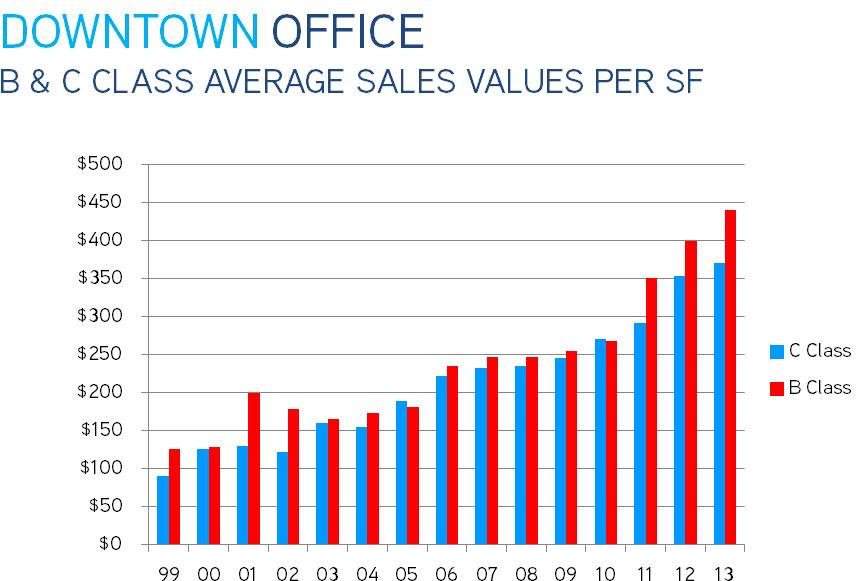

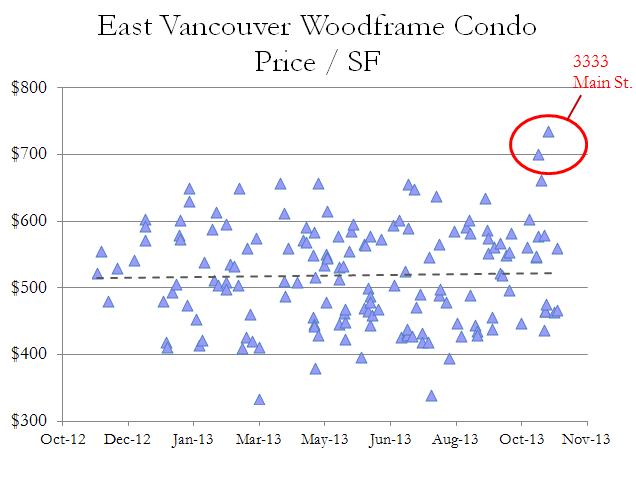

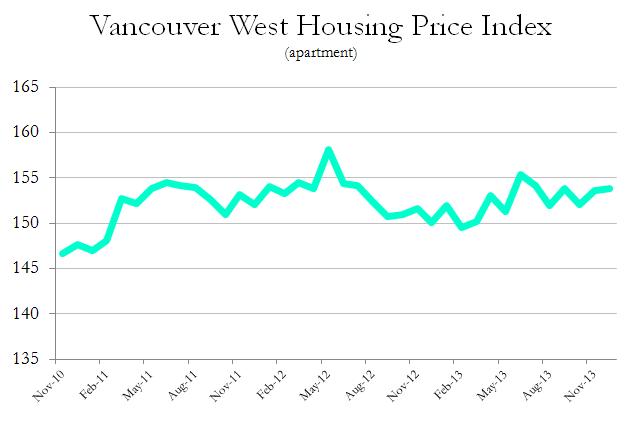

Resales values have likely been suppressed amid a large amount of new inventory coming to market; particularly in areas like Southeast False Creek and Cambie Corridor.

Resales values have likely been suppressed amid a large amount of new inventory coming to market; particularly in areas like Southeast False Creek and Cambie Corridor.