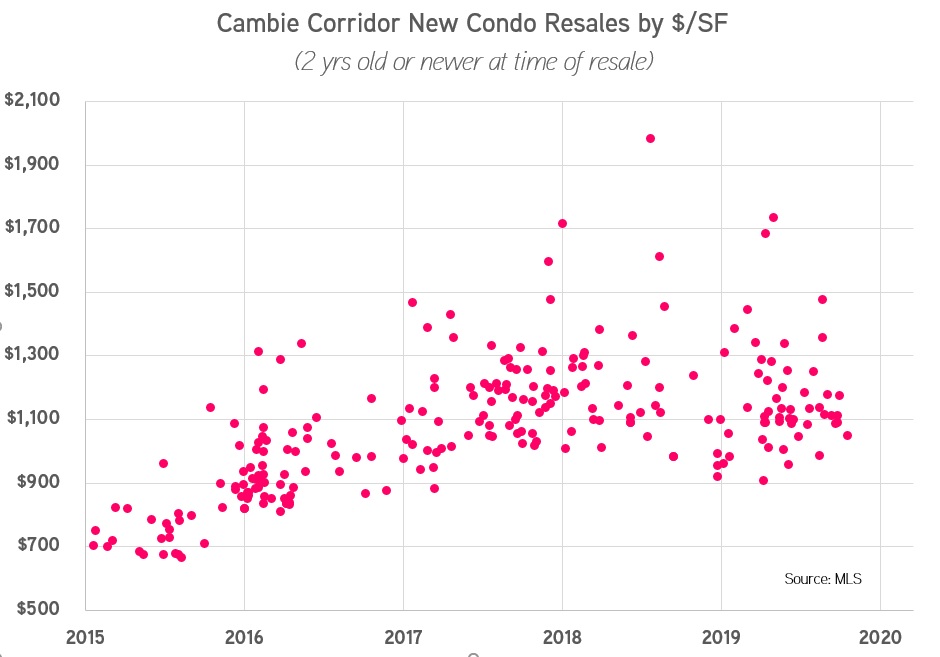

The above chart excludes townhouse and duplex sales.

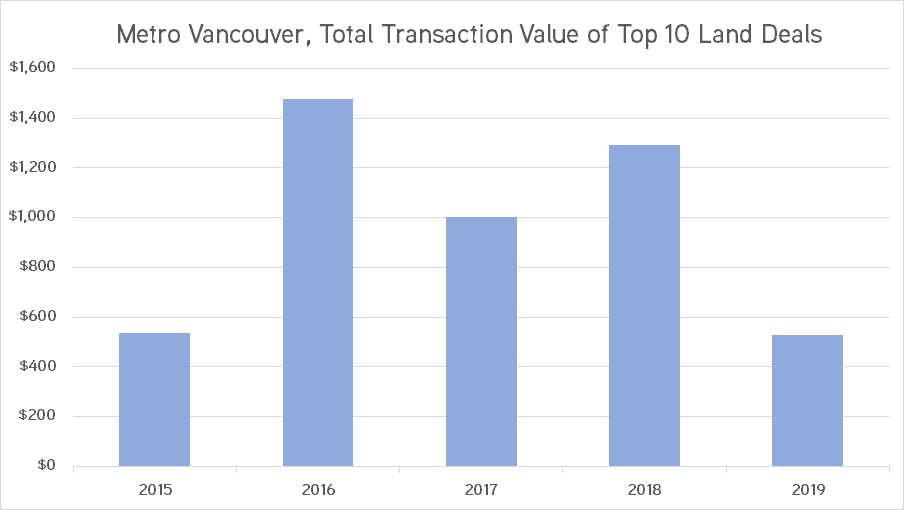

The cooling off started in early 2018, but 2019 land sales data in Metro Vancouver shows the extent of the slowdown.

After a seemingly unstoppable run up in values and transaction activity over the past five years, both prices and number of sales have declined.

After a record 2018 for land sales in Metro Vancouver with $5 Billion in total sales value, the total value for 2019 was down more than half, to $2.4 Billion.

Declines have been offset by continued strength in demand for rental residential and office development. Likewise, more recent activity suggests a return of demand for condo land in the suburbs. Conversely, core luxury condo sites have essentially fallen off the radar.

Here’s a look at each of the 10 largest land deals of 2019:

1. Lougheed & Alpha, Burnaby

The goods: The largest land deal of the year took place in the rapidly transforming Brentwood Town Centre area of Burnaby. The site in question represents a land assembly of auto dealership land and an office building to total a combined 8 acres (some of which already owned by Grosvenor) located at the corner of Lougheed Highway and Alpha Avenue, across the street from Shape’s Amazing Brentwood project, now under construction. The deal closed in October 2019 and represents a long-term redevelopment for Grosvenor.

A rezoning application has now been submitted by Perkins + Will Architects that would establish a master plan for the site. The development plan envisions a high density mixed-use development with condos, rental apartments, retail and office space.

2. 331 Riverside Drive, North Vancouver

The goods: This 3.7-acre site is located in the Maplewood Village area of North Vancouver. The property is currently improved with older lowrise apartment buildings but is designated to allow rezoning for a medium density residential development up to a density of 2.50 FAR. There is currently no timeframe for redevelopment.

3. Plaza 102 Site, Surrey

The goods: This strip mall is located at the corner of 102 Ave and King George Boulevard in the City Centre area of Surrey. The site is directly across 102 from Central City.

There is no word yet on redevelopment, but the City Centre Plan allows for a high density redevelopment up to 7.50 FAR.

4. 18930 & 18970 24th Avenue, Surrey

The goods: This sale involved a large industrial site in the Latimer area of Campbell Heights in South Surrey. An initial rezoning application anticipates rezoning the combined site to allow a new industrial building. Blackstone Property Partners took Pure Industrial (“PIRET”) private in May 2018.

5. 3231 No. 6 Road, Richmond

The goods: Conwest acquired this industrial property, previously occupied by Versacold, in November 2019. The plan includes redevelopment.

6. 4275 Grange Street, Burnaby

The goods: Another tower site in the coveted Metrotown area of Burnaby, this assembly of a strata building was completed by Casey Weeks and Morgan Iannone of Colliers in early 2019. Rezoning details have not been released yet, but the OCP allows a highrise tower.

7. Burke Mountain Site, Coquitlam

The goods: This 9 acre low density residential site in the Partington Creek area of Burke Mountain was sold by the City of Coquitlam to Polygon. After the sale, a development proposal has been submitted which includes 132 townhouse units.

8. 465 East Broadway, Vancouver

The goods: This site was sold by the Colliers team of Oliver Omi and Casey Pollard in April 2019. The site was sold via off-market transaction and includes an older lowrise commercial building. The site is zoned C-2 which allows outright approval for 4-storeys.

9. 3006-3060 Spring Street, Port Moody

The goods: This site is currently an older industrial property, but has significant rezoning potential under the City of Port Moody’s OCP.

10. 6425 Silver Avenue, Burnaby

The goods: This property is designated for high density residential development and includes a 48-unit lowrise apartment building.

Some notes from the above list:

Have a question or a comment on the above? Feel free to contact me.

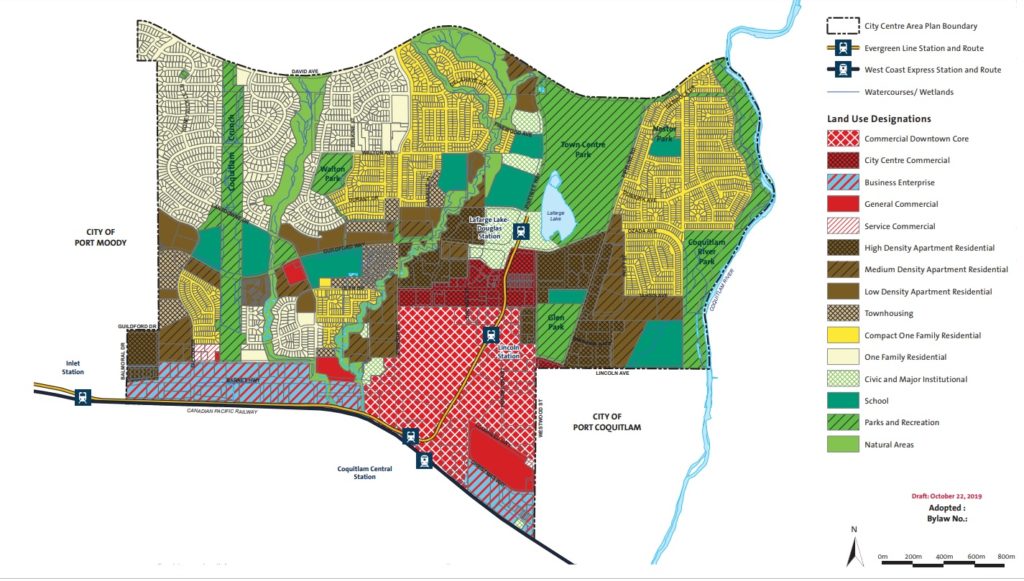

The City of Coquitlam (Council-in Committee) will receive a report outlining the Draft City Centre Area Plan (CCAP), which will form new land use policy for the Coquitlam City Centre area.

The planning effort got underway in the fall of 2018, and is now ready for council consideration and public consultation. The draft document, now completed, will proceed with the next phase of public consultation on the Draft CCAP. Based on that next phase consultation feedback, refinements will be made to the draft CCAP prior to Council’s consideration of bylaw adoption of the Plan in early 2020.

The main objectives of the plan are summarized by five ‘big moves’ outlined in the report, including:

1. Creating a Vibrant Downtown Core: The majority of population and employment growth in City Centre will be directed to a defined, mixed use Commerciai Downtown Core (of approximately 51 hectares/127 acres). The Core will be anchored by an Entertainment District that will serve as a destination for socializing and gathering. The Core will also include a hotel and conference space to serve businesses, tourists and visitors to Coquitlam. Concentrating growth in this manner will establish a sense of vibrancy in the ‘heart’ of City Centre and help create an active downtown.

2. Establishing a Strong Employment Base: A key component of a successful downtown is establishing a strong employment base. To achieve job growth, the amount of employment-generating floor space is recommended to be increased in the Commercial Downtown Core. To help augment employment generating floor space, two Office Business Districts are envisioned for City Centre, which have been strategically situated around a transportation nexus that includes a major bus hub, two SkyTrain stations, a West Coast Express station, and highway access and visibility. These Districts are envisioned to contain a dense concentration of office space, including office towers, situated within high density mixed-use developments along with a mix of other employment-generating businesses. To meet the evolving needs of businesses, several areas outside the Commercial Downtown Core will accommodate Business Enterprise uses to support a thriving downtown.

3. Building a Family-friendly Downtown: The Draft CCAP seeks to establish a family-friendly City Centre through the provision of public and civic amenities, including child care services and a new elementary school site centrally located in City Centre. To meet the varying needs of households of all types and at all stages of life, a variety of housing choices, tenures and price levels will be provided across City Centre. This will be achieved by respecting established neighbourhoods and directing new high density residential developmentto the Commercial Downtown Core.

4. Enhancing Recreation and Cultural Services: Enhancements to civic amenities and the public realm are essential to creating an inviting and active downtown that meets the needs of residents, attracts visitors and businesses to City Centre, and are critical to support a growing community. The CCAP seeks to create a network of parks and publicly accessible open spaces to encourage social interaction and enhance physical and mental well-being. Centrally located civic amenities will contribute to the vibrancy of the Commercial Downtown Core by providing cultural and recreational amenities for residents and businesses.

5. Integrating and Connecting Downtown: Transit-Oriented Development is central to strengthening the area’s role as a Regional City Centre and transportation hub. Improved ease of movement throughout City Centre will be achieved through a finer street grid. Pedestrian-friendly streets, pathways and greenways that are safe, well designed, and seamlessly connect commercial and office development with neighbourhoods, schools, parks, natural areas (including the Coquitlam River), and recreation and cultural facilities will help create an enjoyable, safe, and healthy environment for walking and cycling.

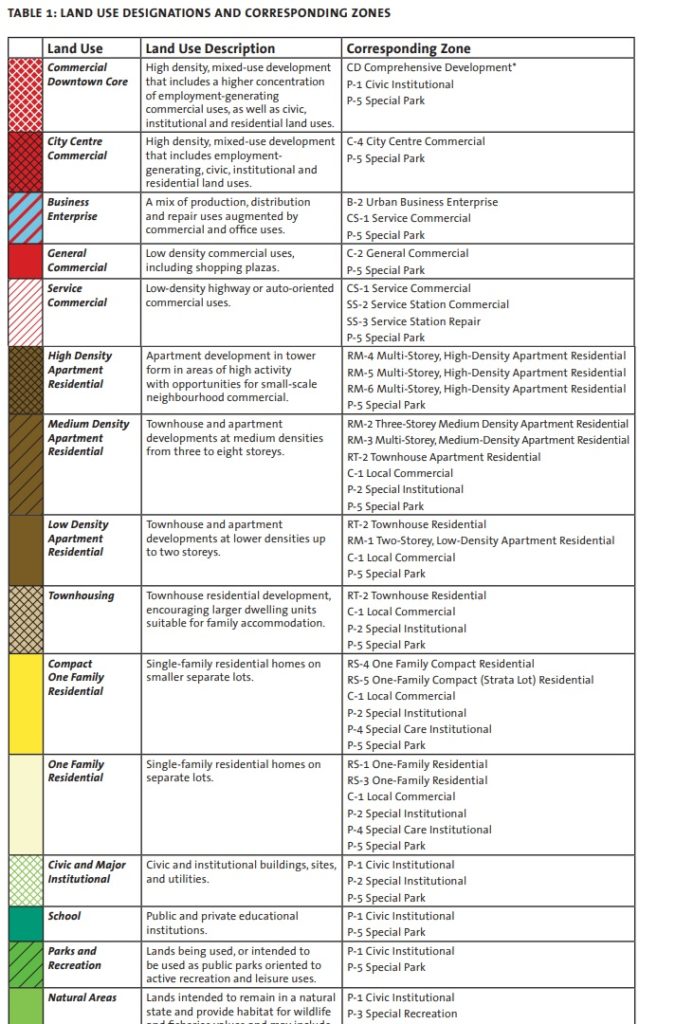

Land Use

The proposed land use changes focus on the Commercial Downtown Core, which is intended to be a major regional centre of commerce and employment, as well as a vibrant mixed-use neighbourhood with high-density residential. To help achieve this active, vibrant downtown, development in the Commercial Downtown Core are recommended for a commercial floor space requirement of 1.0 FAR (rising from current 0.5 FAR). To achieve vibrancy and vitality in and around the Commercial Downtown Core, draft policies seek to create visually interesting, inviting and functional spaces through:

• The establishment of three Precincts (Pinetree-Lougheed Precinct, Lincoln SkyTrain Station Precinct and Four Corners Precinct) in and around key intersections and SkyTrain stations to serve as welcoming destinations in City Centre and form an interconnected ‘spine of activity’ along Pinetree Way.

The report also notes current discussions with major property owners, including: ” Morguard, Marcon, Choice Properties, BentallGreenOak, Polygon and Concert). Recently, another developer (e.g., Ledingham McAllister) has come forward with a proposed land assembly in the Pipeline Road corridor in the vicinity of Glen Drive and Inlet Street. “

The full staff report including draft plan can be viewed here: https://www.coquitlam.ca/docs/default-source/council-agenda-documents/citydocs–3504867-v1-councilincommittee_2019_10_28_-_item_3.pdf?sfvrsn=2

The City of Vancouver released a report and presentation to council today which outlines the proposed process and timeline for a new City-wide Plan which hasn’t occured in almost a century.

The 1995 City Plan also launched a neighbourhood-by-neighbourhood process to create community ‘visions’ and neighbourhood centres. However, the neighbourhood plan process took 14 years to progress, lost momentum, and was eventually redirected into a series of area and community plans, several of which have been completed (Marpole, West End, Downtown Eastside, Grandview-Woodland, Cambie Corridor, etc.)

Below is a brief overview of some of the relevant points presented to City Council as to the planning process:

Objectives

Aside from general planning for future growth, the City outlines the objectives of the City-wide Plan as follows:

Timing

The staff report indicates a general planning and engagement process that is anticipated to take about three years from Council approval of the planning program to adoption of the Citywide Plan. The target date is Q2 2022.

Here is a diagram outlining the various phases:

Impact on Current Zoning/Policies

A new City-wide Plan will potentially impact zoning policy in many areas of the City, including those that already have existing community plans or rezoning policies. The report offers some suggestion as to how these may be dealt with:

Recently Completed Area and Community Plans:

Over the past ten years, the City has approved several new community plans including: Cambie Corridor Plan (2018), Northeast False Creek Plan (2018), Joyce Collingwood Station Area Precinct (2017), False Creek Flats Plan (2017), Grandview-Woodland Community Plan (2016), Marpole Community, Plan (2014), Downtown Eastside Plan (2014) West End Community Plan (2013).

The report notes: “The intent of the City-wide Plan is not to revisit policy directions covered under these plans; however, through the process there will be opportunity to ensure these plans align with the identified values and directions of the new City-wide Plan. Updates and enhancements to various policies and plans may arise in order to improve directions towards the overall vision for the city, or respond to urgent issues and opportunities that arise during the planning process.”

City-wide Policies:

“There are also a number of city-wide land use policies that have been adopted over the years that will be considered through the City-wide Plan process. While applications under these policies/programs will continue to be considered during the planning process, their long-term applicability will be informed by the City-wide Plan. Examples include: Rental 100; Moderate Income Rental Housing Pilot Program (MIRHPP); and the Affordable Housing Choices Program (AHCP).”

Community Visions:

Community Visions including the Norquay Village Neighbourhood Centre Plan and Kingsway and Knight Neighbourhood Centre: Housing Area Plan, will be re-explored through the City-wide Plan process.

Rezoning Enquiries During the Planning Process:

It is being recommended that existing rezoning policies remain in effect during the process, until such time as specific policies are brought forward. This would be anticipated to occur generally towards the end of the planning program, likely in conjunction with the adoption of new policy (e.g. a new City-wide Plan) addressing the areas for which older policy is being updated or repealed to align with new City-wide Plan directions.

Concurrent Planning Programs

The report indicates that time sensitive plans that are already in process including the Broadway Plan and Jericho Lands Policy Statement will continue on and will be coordinated and connected with the City-wide Plan as best as possible.

The City-wide Plan is estimated to require 30-35 staff and will cost $17.9 Million.

General Manager of Planning Gil Kelley has suggested that if approved by Council, community consultation will get underway in or around October 2019.

The full staff report entitled: A City-wide Plan for Vancouver: Report back on General Planning and Engagement Process can be viewed here: https://council.vancouver.ca/20190709/documents/rr1.pdf

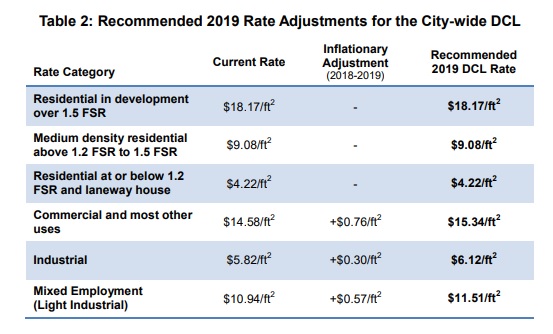

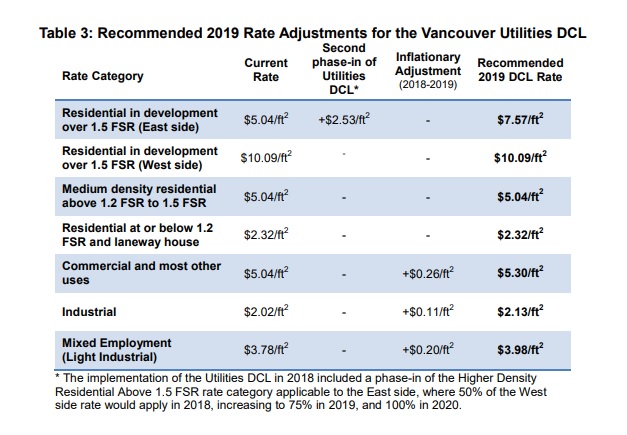

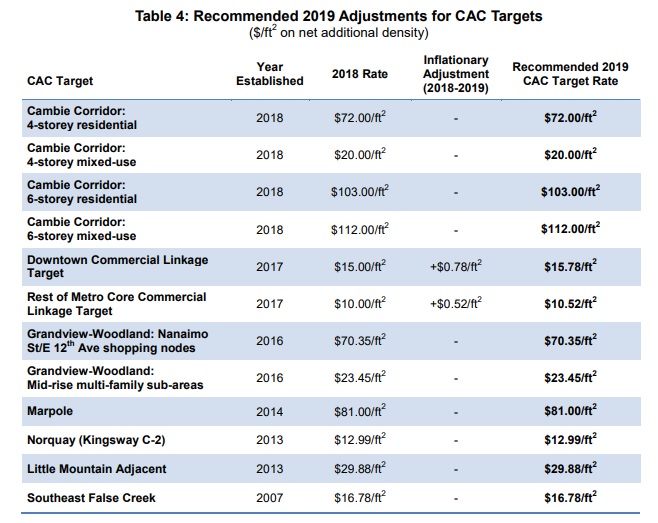

The City of Vancouver is seeking approval for their annual inflationary adjustment to DCL (Development Cost Levy) rates and CAC targets.

The inflationary rate adjustment to DCLs and CAC targets are an annual process that allows the City to keep pace with annual changes in property values and construction costs.

The proposed 2019 inflationary rate adjustment represents an increase of 5.2%, reflecting increases in the cost of land and non-residential construction costs. A core principle behind the annual inflationary rate adjustment system is that it should be able to adapt to market changes. As a result of a weakening residential market, it is recommended that this year’s inflationary rate adjustment be applied only to non-residential rate categories, maintaining existing rates for residential uses. The one exception is the phase-in of the Vancouver Utilities DCL rate for high-density residential development on the east side.

The annual inflation index since 2010 is outlined in the table below:

The 2019 rate adjustments are outlined in the following tables from the City Staff report:

The staff report outlines the following economic rationale for the inflationary rates for both residential and commercial:

The staff report outlines the following economic rationale for the inflationary rates for both residential and commercial:

Residential Market

Target allocations of DCL revenues are estimated as follows:

A full copy of the 2019 Annual Inflationary Rate Adjustment to Development Contributions and Associated DCL Amendments can be viewed here: http://council.vancouver.ca/20170725/documents/p8.pdf

12-unit Gleneagles townhouse project proposed in West Vancouver

A new proposal has surfaced for the parking lot next to Waterfront Station.

The redesigned project includes a 26-storey, 416,000 SF office tower, shaped like a tree, cantilevered over the existing station building.

Architect: James Cheng

Details: https://bit.ly/46aUB0W