While the City of Vancouver grapples with worsening housing affordability conditions, increasingly contentious area plans, and an excruciatingly slow planning process for even modest density increases, Burnaby is quietly going through what is likely one of the most dramatic suburban transformations in the history Metro Vancouver, if not Canada.

Most people have only really begun to take notice more recently with higher and higher towers starting to pop up in Metrotown and now Brentwood. With a strong condo market fuelling demand for new towers near transit, most of Vancouver’s large developers have been active securing sites in Burnaby in the last several years. While the rezoning applications tend not to attract as much attention as those high profile projects in Downtown Vancouver, the magnitude of activity can’t be ignored, particularly when one ponders the scale of projects like Shape Properties’ recently approved Lougheed Town Centre.

How did Burnaby become a hotbed of highrise construction at a scale that dwarfs even the City of Vancouver? You have to go back a few years to understand how the plans were put in place.

The City of Burnaby put plans in place several years ago to concentrate growth in and near major rapid transit (Skytrain) nodes, particularly in four town centre areas they identified as follows:

Furtheremore, unlike homeowners in Vancouver that have been increasingly vocal against even midrise developments, towers in Burnaby have faced less public opposition during rezoning, in part due to the fact that many highrises are being being built in former industrial areas that are being lost to residential, or in areas that are primarily occupied by older rundown apartments where tenants have, seemingly, less influence with the City than single family homeowners.

So far, about 30 highrise towers have been built in these four town centre areas (including 2 office towers), primarily in Metrotown, where projects such as Sovereign by Bosa – a 45-storey hotel and condo tower, and Metroplace by Intracorp – a condo tower near the Metrotown Skytrain station, have each taken advantage of sizeable density increases per the Metrotown Town Centre plan. The sales velocity and pricing of each new development spurs even greater interest for new projects and generates more and more rezoning applications. Land speculation is now commonplace, particularly in more mature areas such as Metrotown.

The City of Burnaby’s willingness to allow fairly substantial density on previously underutilized parcels of land previously dedicated to commercial and industrial use has vaulted Burnaby far ahead of any area in Metro Vancouver in terms of highrise construction. Shape Properties’ two mall sites: Brentwood and Lougheed, are the largest and most well known, but others such as Onni’s Gilmore Station (rumored to include BC’s new tallest tower) and Concord’s Brentwood projects are massive themselves and in terms of height and scale, tower over Vancouver’s most ambitious plans such as the recently scaled back Oakridge.

A review of current and forthcoming developments in the City of Burnaby shows over 100 highrises in various stages of development (under application or construction), almost all of them intended for residential condos, with a handful of commercial office towers usually required on the larger scale developments to preserve job space. A few stats show the scale of this wave of development in Burnaby:

- 106 highrises under development (compared to 68 in the City of Van)

- 47 highrises of 40-storeys or more (compared 13 in the City of Van)

- Over 30,000 units under development (excluding lowrise and townhouse units)

Here is a breakdown of all of this activity, by each area of Burnaby:

[table id=20 /]

[table id=21 /]

[table id=22 /]

[table id=23 /]

The above floor & unit counts are best estimates unless otherwise confirmed in City of Burnaby planning/rezoning application documents.

It is anticipated that there will be more rezoning applications forthcoming in the near future, particularly as the Town Centre Plans are further refined; however, it can be argued that the majority of the most central and logical development sites have now been secured by developers. With a very active presales market and continued upward trajectory of condo prices, it can be anticipated that land costs will continue to increase for these Burnaby tower sites in the future, with areas such as Port Moody and Coquitlam seeking to catch some of the spillover of this growth in conjunction with the 2017 completion of the Evergreen Line.

With the height and scale of these projects in Burnaby, it will be interesting to see what, if any response the City of Vancouver has while it struggles to create even modest height and density in increasingly expensive and largely unaffordable areas.

For the record, I am not espousing the virtues of density as the primary means of increasing affordability. In fact, if Burnaby is behind in an area, it is in the creation of new rental units for which there is currently no coherent or substantive policy. This, in part, has helped the viability of several projects since rental replacement is not a requirement like it is in other municipalities. The City of Vancouver has been more proactive in the provision of affordable housing which has hopefully had at least a moderate impact in terms of affordability.

The above data contains all downtown Vancouver condo resales. For simplicity, all luxury condo sales above $2,000 per SF were removed (approx. 40 sales).

The above data contains all downtown Vancouver condo resales. For simplicity, all luxury condo sales above $2,000 per SF were removed (approx. 40 sales).

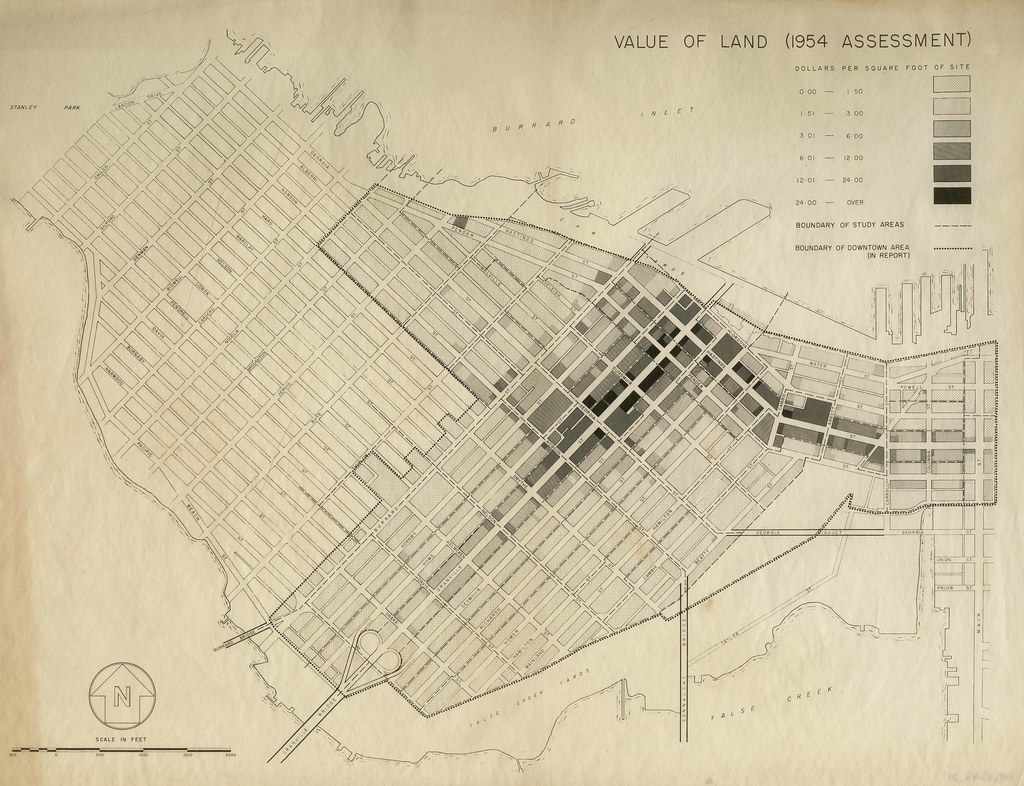

“Scope and content Item is a map showing land values in dollars per square foot for the downtown area bounded by Burrard Street, Robson Street, and Nicola Street in the west and Main Street in the east.”

“Scope and content Item is a map showing land values in dollars per square foot for the downtown area bounded by Burrard Street, Robson Street, and Nicola Street in the west and Main Street in the east.”